Renters Insurance Food Loss Coverage: Complete Protection Guide

Understanding renters’ insurance food loss coverage

Renters insurance does cover food loss, but solely under specific circumstances. This coverage typically applies when food spoil due to power outages cause by covered perils such as storms, fires, or equipment failures. Understand these nuances can mean the difference between receive compensation for your spoiled groceries and pay out of pocket.

Most renters insurance policies include food spoilage coverage as part of their standard personal property protection. Notwithstanding, the coverage amount is commonly limited, much range fro$50000 to$11,000 per incident. This limitation make it crucial to understand precisely when and how this coverage applies.

Cover scenarios for food loss

Your renters’ insurance will cover food loss when specific conditions are meet. The almost common scenario involve power outages last more than a predetermined period, typically 24 to 48 hours, depend on your policy terms.

Power outages from covered perils

When storms, fires, or others will cover disasters will cause power outages that lastproficientt sufficiency to will spoil your food, your insurance will typically will provide compensation. The key requirement is that the power loss must result from a cover peril under your policy.

For example, if a severe thunderstorm damages power lines in your area, cause your refrigerator and freezer to lose power for 36 hours, the result food spoilage would potentially be cover. Likewise, if a fire at a nearby electrical substation cause extend power loss, your spoiled food costs coulbe reimbursedse.

Mechanical breakdown coverage

Some policies extend coverage to mechanical breakdowns of refrigeration equipment. If your refrigerator or freezer dead stop work due to mechanical failure, the result food loss might be cover. Yet, this coverage oftentimes requires the appliance to be comparatively new or right maintain.

The breakdown must be sudden and accidental quite than due to normal wear and tear or lack of maintenance. Regular maintenance records can be helpful when file claims for mechanical breakdown relate food loss.

Exclusions and limitations

Understand what your renters’ insurance does not cover regard food loss is as important. Several common exclusions can leave you responsible for spoiled food costs.

Planned power outages

Schedule maintenance or plan power outages by utility companies are typically not cover. Since these outages are announced in advance, insurance companies expect tenants to take preventive measures to protect their food.

Short duration outages

Brief power interruptions that endure less than the minimum time will specify in your policy will not will trigger coverage. Most policies require outages to last at least 24 hours before food spoilage coverage apply.

Gradual deterioration

Food that spoil due to gradual temperature changes, improper storage, or normal expiration is not cover. The spoilage must result from a sudden, covered event sooner than gradual deterioration over time.

Coverage limits and deductibles

Food spoilage coverage typically come with specific dollar limits that are separate from your overall personal property coverage. These limits commonly range from $500 to $$1500, depend on your policy and insurance company.

Most food spoilage claims are subject to your policy deductible. If your deductible is $500 and your food loss is $$400 you’d receive no compensation. Notwithstanding, some insurers waive deductibles for food spoilage claims or apply a lower deductible specifically for this coverage.

Increase coverage limits

If you regularly keep expensive food items or have a large household, consider increase your food spoilage coverage limits. Many insurers offer endorsements or riders that can increase these limits for a small additional premium.

Families with special dietary needs, those who buy in bulk, or households with expensive specialty foods might benefit from higher coverage limits. The additional cost is much minimal compare to the potential out-of-pocket expenses.

File a food loss claim

Successfully file a food loss claim require proper documentation and timely reporting. The claims process for food spoilage is broadly straightforward, but attention to detail is essential.

Immediate steps

Contact your insurance company arsenic shortly as possible after discover the food loss. Many insurers have 24 hour claim report hotlines, and prompt reporting can expedite the claims process.

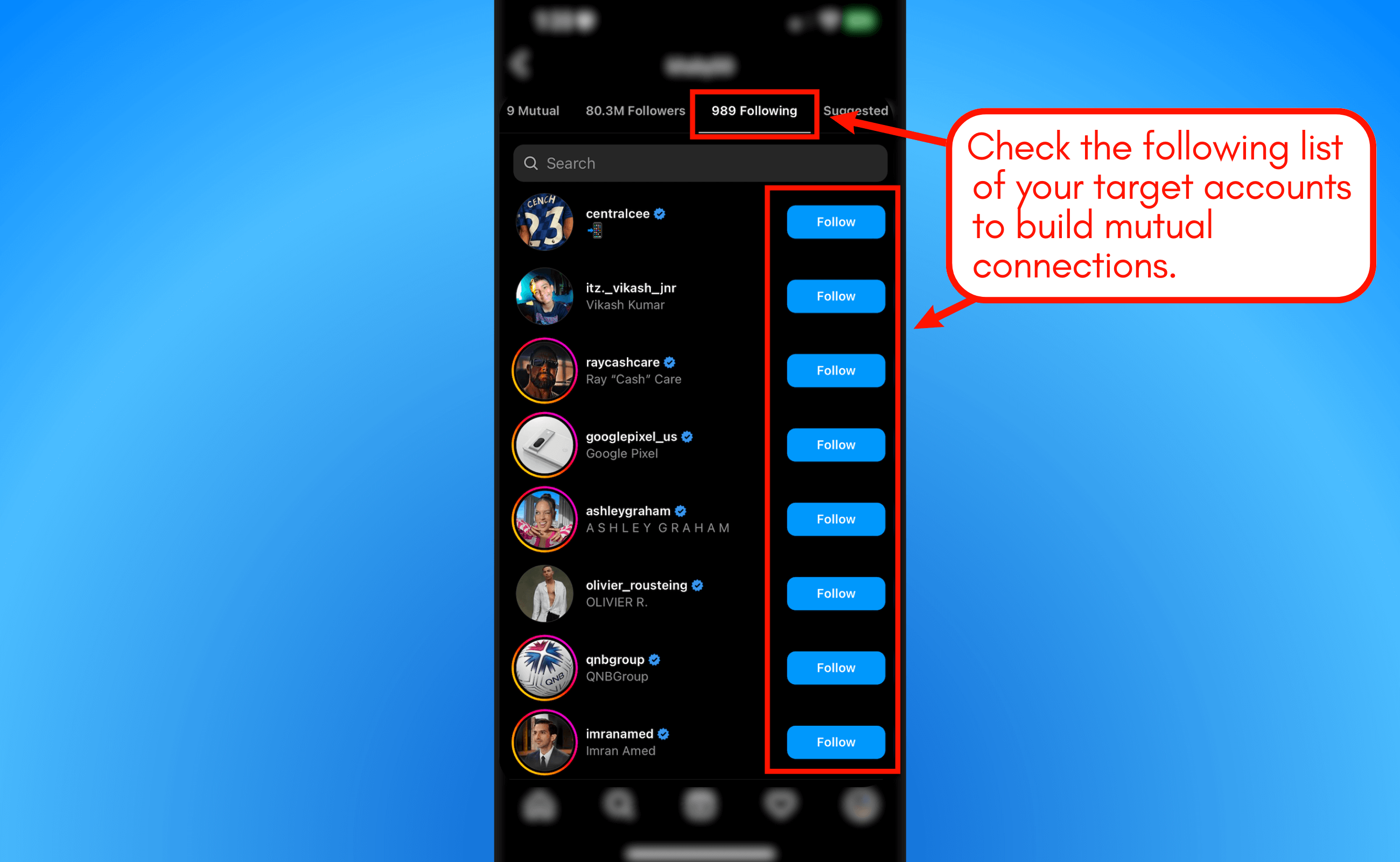

Document the cause of the power outage or equipment failure. Take photos of your spoiled food before dispose of it, and keep receipts show recent grocery purchases. If possible, obtain a statement from your utility company confirm the power outage duration.

Source: onceuponatefl.com

Required documentation

Insurers typically require specific documentation to process food spoilage claims. This includes proof of the cover peril that cause the loss, evidence of the food spoilage, and documentation of the food’s value.

Keep recent grocery receipts, take photos of spoiled items, and maintain a detailed list of discard food with estimate values. Some insurers accept reasonable estimates for common food items, while others may require more detailed documentation.

Maximize your food loss protection

Several strategies can help maximize your protection against food loss and ensure you receive full compensation when cover events occur.

Regular inventory

Maintain a regular inventory of expensive or specialty food items in your refrigerator and freezer. This documentation proves valuable when file claims and help ensure you don’t overlook items when calculate losses.

Consider take periodic photos of your refrigerator and freezer contents, specially after major grocery shopping trips. These photos can serve as evidence of your food inventory before a loss occur.

Understand your policy

Review your renters insurance policy cautiously to understand your specific food spoilage coverage terms. Pay attention to coverage limits, deductible amounts, and the minimum duration require for power outages.

If your current coverage seems inadequate, discuss options with your insurance agent. Many insurers offer affordable endorsements that can importantly increase your food spoilage protection.

Alternative protection strategies

While renters insurance provide valuable food loss protection, additional strategies can help minimize your risk and potential losses.

Preventive measures

Invest in a generator or battery backup system for essential appliances if you live in an area prone to extend power outages. These devices can prevent food spoilage during short to moderate length outages.

Consider purchasing appliance insurance or extended warranties that cover mechanical breakdowns of refrigeration equipment. These policies can complement your renters’ insurance coverage and provide additional protection.

Smart shopping habits

Avoid overstock perishable items, specially during severe weather seasons when power outages are more likely. Buy smaller quantities more often to reduce potential losses during unexpected outages.

Keep non-perishable emergency food supplies on hand to reduce your dependence on refrigerate items during extended outages. This strategy can minimize both inconvenience and potential financial losses.

Work with your insurance company

Build a good relationship with your insurance company and understand their specific procedures can streamline the claims process when food loss occur.

Communication best practices

Maintain clear, document communication with your insurer throughout the claims process. Keep records of all phone calls, emails, and write correspondence relate to your claim.

Be honest and thorough when report losses, but avoid exaggerate or inflate values. Insurance companies have experience with food costs and can easily identify unrealistic claims.

Source: YouTube.com

Understanding settlement options

Most food spoilage claims are settled base on actual cash value kinda than replacement cost. This meanyou willl receive compensation will base on the current value of the spoiled food, which may be less than what you earlier pay.

Some insurers offer replacement cost coverage for food spoilage as an optional endorsement. This coverage type reimburses you for the full cost of replace spoil food at current prices.

Special considerations for different living situations

Different rental situations may affect your food loss coverage and claim procedures. Understand these variations help ensure you have appropriate protection.

Apartment living

Apartment dwellers may face unique challenges when document power outages or equipment failures. Building management companies can oftentimes provide documentation of power outages or refrigeration equipment problems.

If your apartment building’s central electrical system fail, affect multiple units, this documentation can strengthen your claim. Coordinate with neighbors who experience similar losses to gather comprehensive evidence.

Single family rental homes

Renters of single family homes may have more control over their electrical systems and appliances but to bear more responsibility for maintenance. Ensure you understand which appliances are your responsibility versus your landlord’s.

Keep maintenance records for appliances you’re responsible for maintain, as these records may be required when file mechanical breakdown claims.

Future trends in food loss coverage

The insurance industry continue to evolve to address change consumer needs and technological advances. Several trends may affect future food loss coverage options.

Smart home integration

Smart home devices that monitor refrigerator temperatures and power status may shortly play a role in food loss claims. These devices can provide precise documentation of when and how long power outages occur.

Some insurers are begun to offer discounts for policyholders who use smart home monitoring systems, recognize their value in prevent and document losses.

Climate change considerations

Increase frequency of severe weather events may lead to changes in food spoilage coverage terms and pricing. Insurers may adjust coverage limits or requirements base on regional climate risks.

Consider how climate trends in your area might affect your food loss risks and whether additional coverage or preventive measures would be beneficial.

Understand your renters’ insurance food loss coverage empower you to make informed decisions about your protection needs and claim procedures. Regular policy reviews and proper documentation practices ensure you’re prepared when unexpected food spoilage occur.