PhD in Finance: Complete Guide to Advanced Financial Education

Understand the PhD in finance

A PhD in finance represent the highest level of academic achievement in financial studies. This doctoral degree prepare graduates for careers in academia, research, and high level positions in financial institutions. The program combine rigorous theoretical training with practical research skills, create experts who can contribute original knowledge to the field of finance.

Finance PhD programs typically require four to six years of full-time study. Students engage in coursework cover advanced topics like asset pricing, corporate finance, behavioral finance, and econometrics. The curriculum emphasize mathematical modeling, statistical analysis, and empirical research methods essential for conduct meaningful financial research.

Admission requirements and prerequisites

Most PhD programs in finance have stringent admission requirements. Applicants typically need a bachelor’s degree, though many successful candidates hold master’s degrees in finance, economics, or related fields. Strong quantitative skills are essential, with many programs require coursework in calculus, statistics, and linear algebra.

The graduate record examination (gGRE)or graduate management admission test ( (aGMAT)ores are standard requirements. Top programs oft expect gre GREntitative scores in the 90th percentile or higher. Some programs too require the gre GREject test in mathematics or economics.

Academic transcripts should demonstrate excellence in quantitative courses. Research experience, whether through undergraduate research programs, master’s thesis work, or professional research roles, strengthen applications importantly. Letters of recommendation from faculty members or research supervisors carry substantial weight in the admission process.

Personal statements should clear articulate research interests and career goals. Admissions committees look for candidates who demonstrate genuine passion for financial research and clear understanding of the academic path leading.

Core curriculum and coursework

PhD programs in finance feature intensive coursework in the first two years. Core subjects include advanced corporate finance, investments, derivatives, financial econometrics, and asset pricing theory. Students besides take courses in microeconomics, macroeconomics, and advanced statistics or econometrics.

Mathematical finance courses cover stochastic calculus, continuous time finance, and advanced option pricing models. Empirical methods courses teach students how to analyze financial data use sophisticated statistical techniques and software packages like SAS, r, and python.

Specialized electives allow students to focus on specific areas such as behavioral finance, international finance, real estate finance, or financial institutions. Many programs besides require students to take courses outside the finance department, oftentimes in economics, accounting, or statistics departments.

The curriculum emphasize both theoretical understanding and practical application. Students learn to develop and test financial theories use real world data, prepare them for independent research in their dissertation phase.

Research and dissertation requirements

The dissertation represent the culmination of PhD studies in finance. Students must identify an original research question, develop appropriate methodology, collect and analyze data, and present findings that contribute new knowledge to the field.

Dissertation topics span various areas of finance. Some students focus on asset pricing anomalies, while others examine corporate financial decisions, market microstructure, or behavioral aspects of financial markets. The research must demonstrate mastery of relevant literature, appropriate methodology, and significant original contribution.

Most programs require students to pass comprehensive examinations before begin dissertation research. These exams test knowledge of core finance concepts and research methods. Students likewise present their dissertation proposal to a committee of faculty members for approval.

The dissertation process typically takes two to three years. Students work intimately with faculty advisors and committee members, present their progress at regular intervals. Many students present their research at academic conferences and submit papers topeer-revieww journals during this phase.

Career opportunities and outcomes

PhD graduates in finance pursue diverse career paths. Academic careers remain popular, with graduates seek positions as assistant professors at universities and colleges. The academic job market is competitive, but graduates from strong programs oftentimes secure tenure track positions at respected institutions.

Industry careers offer attractive alternatives. Investment banks, asset management firms, hedge funds, and consult companies actively recruit finance PhDs. These positions oftentimes involve quantitative analysis, risk management, or strategic advisory roles.

Central banks and regulatory agencies likewise employ finance PhDs as researchers and policy analysts. These roles combine academic research skills with practical policy applications, offer opportunities to influence financial regulation and monetary policy.

Corporate finance positions at large companies represent another career path. Finance PhDs may work in treasury departments, strategic planning roles, or as chief financial officers, bring advanced analytical skills to corporate decision-making.

Financial considerations and funding

Well-nigh reputable phPhDrograms in finance offer full funding to admit students. This typically include tuition waivers, health insurance, and stipends for living expenses. Funding commonly come through teaching assistantships, research assistantships, or fellowships.

Teaching assistantships require students to help with undergraduate courses, gain valuable teaching experience while earn their stipend. Research assistantships involve work on faculty research projects, provide hands-on experience with academic research processes.

External funding opportunities include grants from organizations like the national science foundation or private foundations. Some students besides receive support from their home countries if they’re international students.

The opportunity cost of pursue a PhD should be considered cautiously. Students forgo several years of potential earnings while in school, though the long term career benefits oftentimes justify this investment.

Choose the right program

Select an appropriate PhD program require careful consideration of multiple factors. Program reputation and faculty quality importantly impact career prospects. Rankings from organizations like u.s. news & world report provide useful guidance, though they should not be the sole decide factor.

Faculty research interests should align with student interests. Prospective students should review faculty publications and research areas to identify programs where they can find suitable advisors and research opportunities.

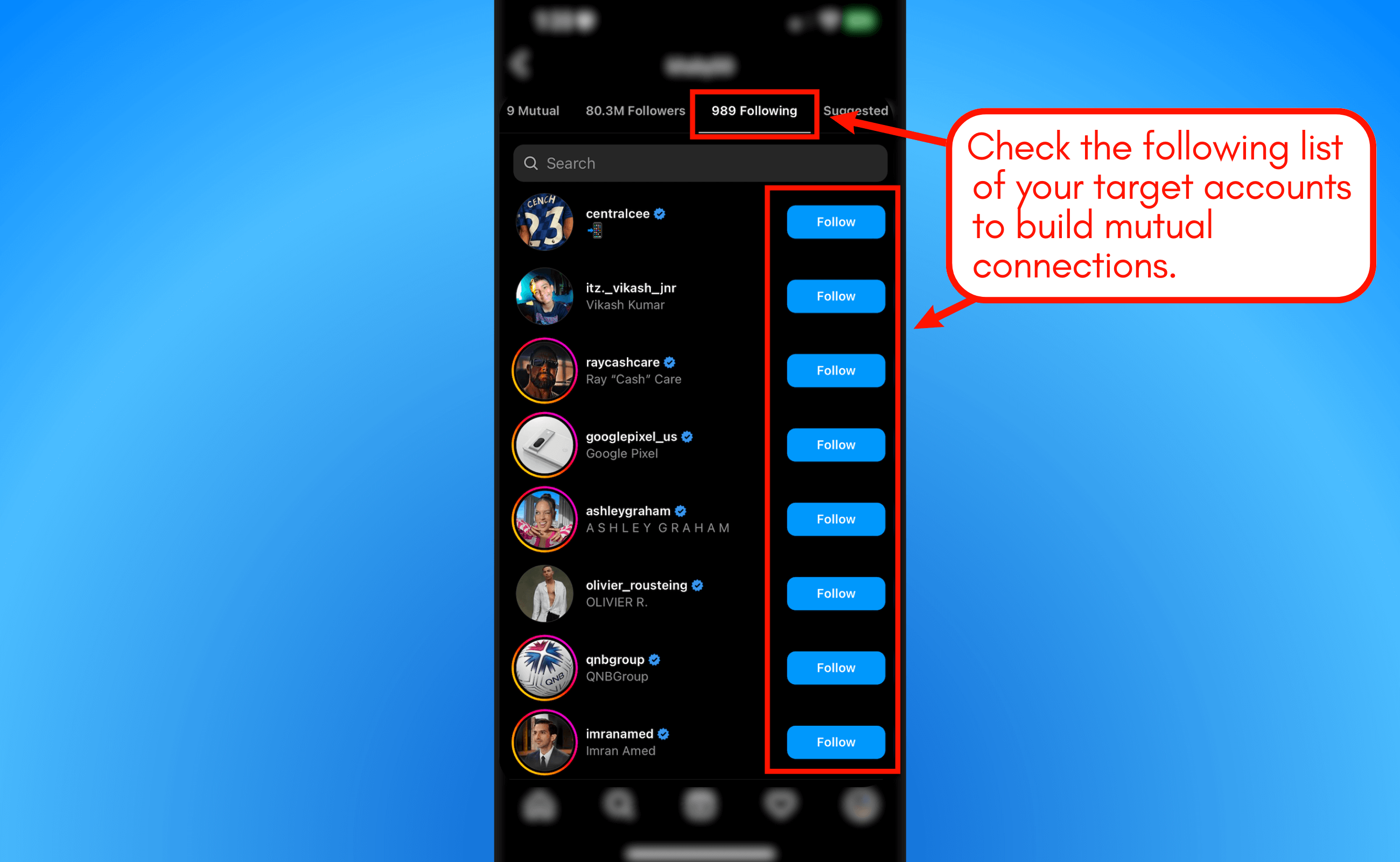

Source: cantechonline.com

Program structure and requirements vary across institutions. Some programs emphasize theoretical research, while others focus more on empirical analysis. Students should choose programs that match their research preferences and career goals.

Location and cost of live affect the graduate school experience. While most programs provide funding, stipend amounts vary, and living costs differ importantly across locations. Students should consider whether stipends provide adequate support for their circumstances.

Prepare for success

Success in PhD programs require strong preparation and realistic expectations. Prospective students should strengthen their quantitative skills through additional coursework if neededneed. Online courses in mathematics, statistics, and programming can help build necessary foundations.

Research experience prove invaluable for PhD preparation. Students can seek research opportunities through undergraduate research programs, internships, or entry level research positions at financial institutions or think tanks.

Read academic finance journals help students understand the current state of research and identify interesting questions. Journals like the journal of finance, review of financial studies, and journal of financial economics showcase high quality research in the field.

Network with current PhD students and recent graduates provide insights into program experiences and career outcomes. Many universities host prospective student days when applicants can meet faculty and current students.

Alternative paths and considerations

While a PhD in finance offer significant opportunities, it may not be the right choice for everyone. Professional master’s programs in finance or MBA degrees might advantageously serve students principally interested in industry careers preferably than research or academia.

The chartered financial analyst (cCFA)designation provide professional credibility for many finance careers without require doctoral level study. This certification focus on practical investment analysis and portfolio management skills.

Some students pursue PhDs in related fields like economics or accounting, which can besides lead to finance relate careers. These programs may offer different perspectives on financial questions and potentially different career opportunities.

Part-time or executive phPhDrograms serve work professionals who want to pursue doctoral studies while maintain their careers. These programs typically take longer to complete but allow students to cocontinue to earnncome during their studies.

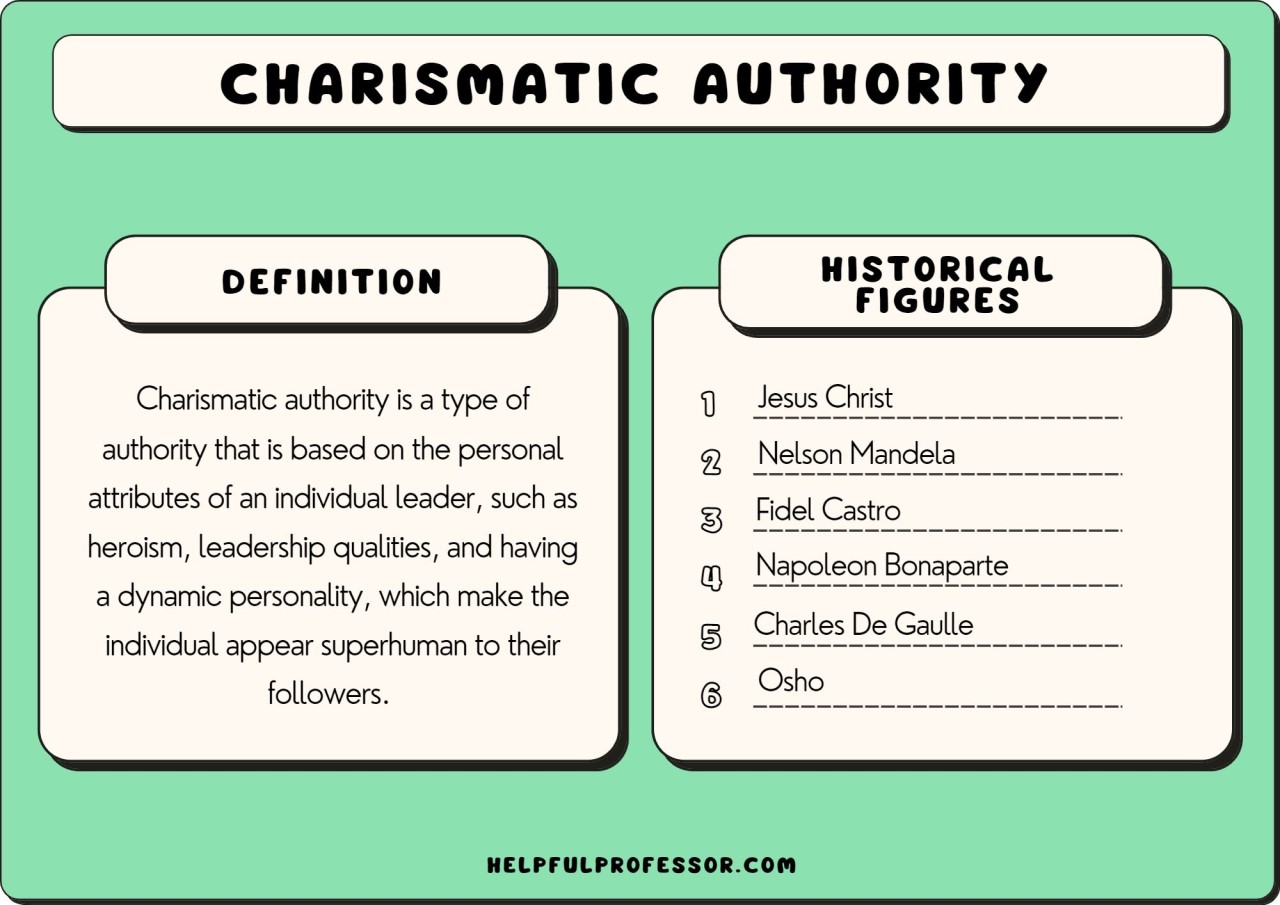

Source: scottrhodesillustrator.blogspot.com

The decision to pursue a PhD in finance represent a significant commitment that can lead to rewarding careers in academia, industry, or public service. Success require careful preparation, realistic expectations, and dedication to rigorous study and research. For those passionate about understand financial markets and contribute new knowledge to the field, a PhD in finance offer unparalleled opportunities for intellectual growth and professional achievement.