Lifestyle Creep: Complete Guide to Prevention and Financial Protection

What does lifestyle creep?

Lifestyle creep, to know as lifestyle inflation, occur when your spending increases proportionately or disproportionately to your income growth. As people earn more money, they oftentimes upgrade their living standards by purchase more expensive items, move to costlier homes, or adopt pricier habits. While some lifestyle improvements are natural and deserved, unchecked lifestyle creep can wordlessly erode your financial progress and delay important goals like retirement, homeownership, or debt freedom.

This phenomenon typically happens gradually, make it difficult to notice until significant financial damage hasoccurredr. A promotion might lead to dine out more often, a bonus could justify a luxury car purchase, or a salary increase might prompt a move to an expensive neighborhood. Each decision seem reasonable in isolation, but jointly, they can trap you in a cycle of increase expenses that match or exceed your income growth.

Common signs of lifestyle creep

Recognize lifestyle creep betimes is essential for maintaining financial health. Several warning signs indicate that your spending mbe outpacedace your financial goals. Monthly expenses that systematically increase without correspond improvements in your savings rate represent a clear red flag. When your discretionary spending categories like entertainment, dining, and shopping grow importantly after income increases, lifestyle creep has probatakentake hold.

Another telltale sign involve justify purchases base on your new income level kinda than actual need or value. Phrases like” iIcan afford it nowadays ” r “” dIserve this upgrade ” ” entimes accompany lifestyle creep decisions. Additionally, if your emergency fund or retirement contributions remain stagnant despite earn more money, your increase spending has potential consume the additional income.

Credit card balances that grow or remain high despite income increases too signal problematic spending patterns. When higher earners maintain the same debt levels as when they earn less, lifestyle inflation has typically absorbed their increase earning power.

The psychology behind lifestyle creep

Understand the psychological drivers of lifestyle creep help explain why evening financially aware individuals fall into this trap. Social comparison play a significant role, as people oftentimes adjust their spending to match their peer groups or professional circles. Higher earn positions oftentimes involve socialize with others who have expensive tastes, create pressure to maintain similar consumption patterns.

The hedonic treadmill concept to contribute to lifestyle creep. This psychological principle suggest that people promptly adapt to improved circumstances, require progressively expensive purchases to maintain the same level of satisfaction. What erstwhile feel like a luxury become the new normal, drive continued spending increases.

Loss aversion psychology make lifestyle downgrades feel especially painful, yet when financially necessary. Once someone become accustomed to premium products or services, return to previous options feel like a significant sacrifice instead than a return to an antecedently acceptable standard.

Financial impact of unchecked lifestyle creep

The long term financial consequences of lifestyle creep extend far beyond monthly budget concerns. Compound interest work both ways – while grow savings benefit from exponential growth over time, miss savings opportunities create exponentially larger losses in future wealth.

Consider someone who receive a $10,000 annual raise but increase their spending by the same amount rather of save the difference. Over 30 years, assume a 7 % annual return, that miss savings opportunity cost roughly $$944000 in future wealth. This dramatic example illustrate why control lifestyle creep is crucial for long term financial success.

Lifestyle creep to increase financial vulnerability during economic downturns or personal emergencies. Higher fix expenses require larger emergency funds and make job loss or income reduction more devastating. Individuals with inflate lifestyles oftentimes struggle to reduce expenses rapidly when circumstances change, lead to debt accumulation or financial crisis.

Moreover, lifestyle creep can delay major financial milestones like homeownership, debt payoff, or retirement. When increase income go toward consumption kinda than savings, important goals remain out of reach despite higher earnings.

Proven strategies to prevent lifestyle creep

Prevent lifestyle creep require intentional planning and discipline execution. The virtually effective approach involve automate savings increases whenever income grow. Before lifestyle adjustments can occur, instantly direct a significant portion of any raise, bonus, or additional income toward savings, investments, or debt repayment.

The 50/30/20 rule provide a framework for balanced spending, allocate 50 % of after tax income to needs, 30 % to wants, and 20 % to savings and debt repayment. When income increases, maintain these percentages instead than allow the” wants ” ategory to expand disproportionately.

Create specific financial goals with target dates helps maintain focus on long term priorities sooner than immediate gratification. Whether save for retirement, a home down payment, or debt freedom, clear objectives provide motivation to resist unnecessary spending increases.

Regular budget reviews, conduct monthly or quarterly, help identify creep expenses before they become problematic. Track spend categories over time to ensure that increase align with your values and financial goals instead than occur unconsciously.

Smart approaches to lifestyle upgrades

Altogether avoid all lifestyle improvements isn’t realistic or necessary. The key lie in make intentional, value base decisions instead than automatic upgrades. Before make any significant purchase or lifestyle change, implement a waiting period to ensure the decision aligns with your long term goals.

Focus upgrades on items that provide genuine value or importantly improve your quality of life. Invest in better health, education, or tools that increase your earn potential oftentimes justify the expense. Nonetheless, status drive purchases that provide minimal practical benefit should be approach with extreme caution.

Consider upgrade gradually sooner than make dramatic changes completely at east. This approach allow you to appreciate improvements while maintain perspective on your previous lifestyle. It besides provide opportunities to assess whether upgrades sincerely enhance your satisfaction or only satisfy temporary desires.

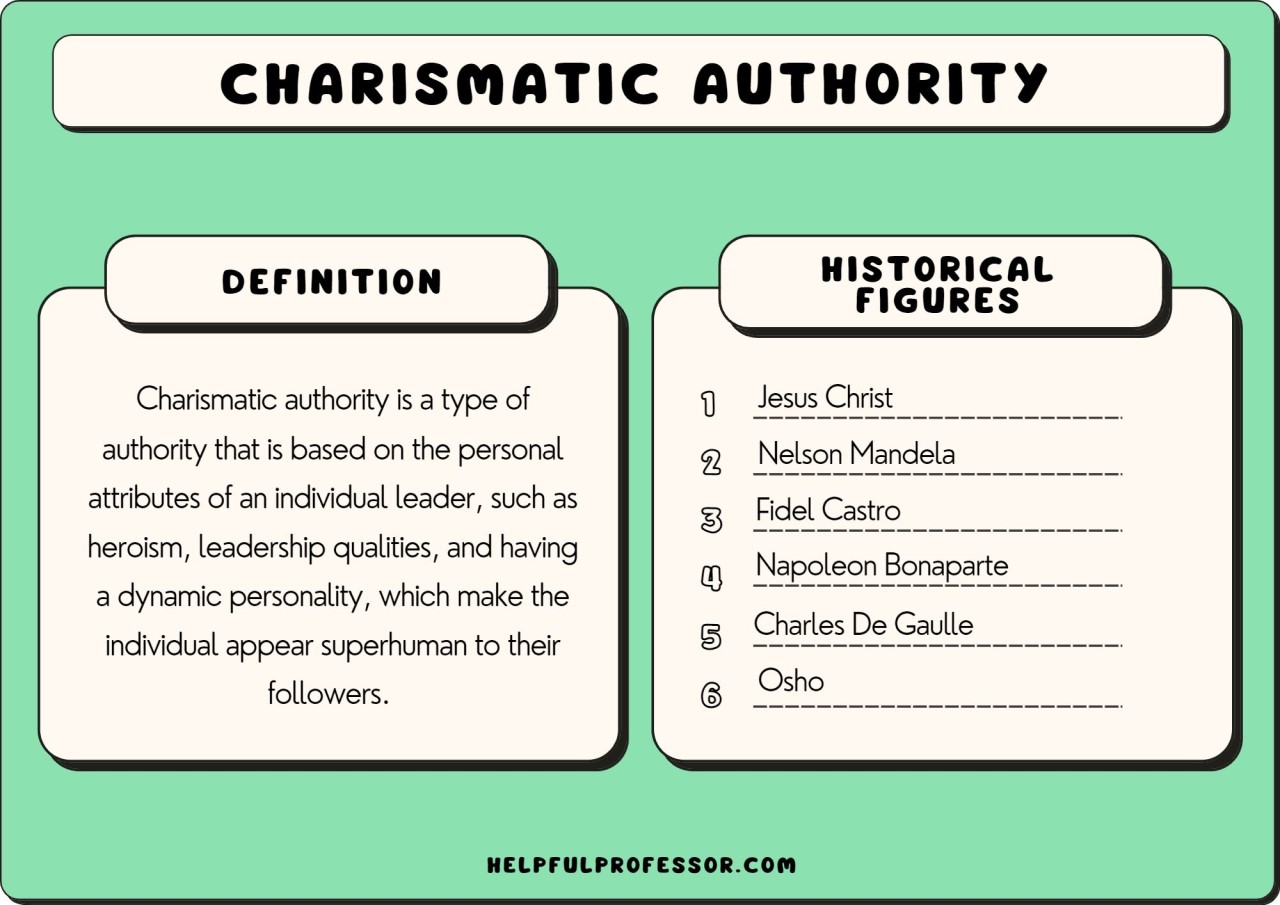

Source: corporette.com

Build financial discipline

Develop strong financial discipline require both systems and mindset changes. Automate as many financial decisions as possible to remove temptation and ensure consistent progress toward your goals. Set up automatic transfers to savings accounts, investment accounts, and debt payments instantly after receive income.

Create artificial scarcity by treat savings goals as non-negotiable expenses. Pay yourself start, so live on the remainder instead than save whatever money is leave after spend. This approach ensure that lifestyle creep can not consume funds designate for financial security.

Develop contentment practices that reduce the desire for constant upgrades. Gratitude exercises, mindfulness practices, and focus on experiences quite than possessions can help break the cycle of need progressively expensive items for satisfaction.

The role of values bases spending

Align spending decisions with personal values provide a framework for evaluate lifestyle upgrades. Identify what matter near to you – whether that’s family time, travel, health, education, or financial security – and prioritize spending in those areas while being more restrictive elsewhere.

Values base spending doesn’t mean live frugally in all areas, but kinda being intentional about where you choose to spend more money. Someone who value travel might allocate significant funds to vacations while maintain modest housing and transportation costs. This approach allow for lifestyle improvements in meaningful areas without fall into general lifestyle creep.

Regular reflection on your values and spending alignment help maintain perspective during income increases. Ask yourself whether propose upgrades support your core values or only represent unconscious consumption increases.

Create accountability systems

Accountability systems help maintain discipline when face with lifestyle upgrade temptations. Share your financial goals with trust friends or family members who can provide perspective when you’re considered significant purchases. Sometimes external viewpoints help identify when desires are drive decisions instead than genuine needs.

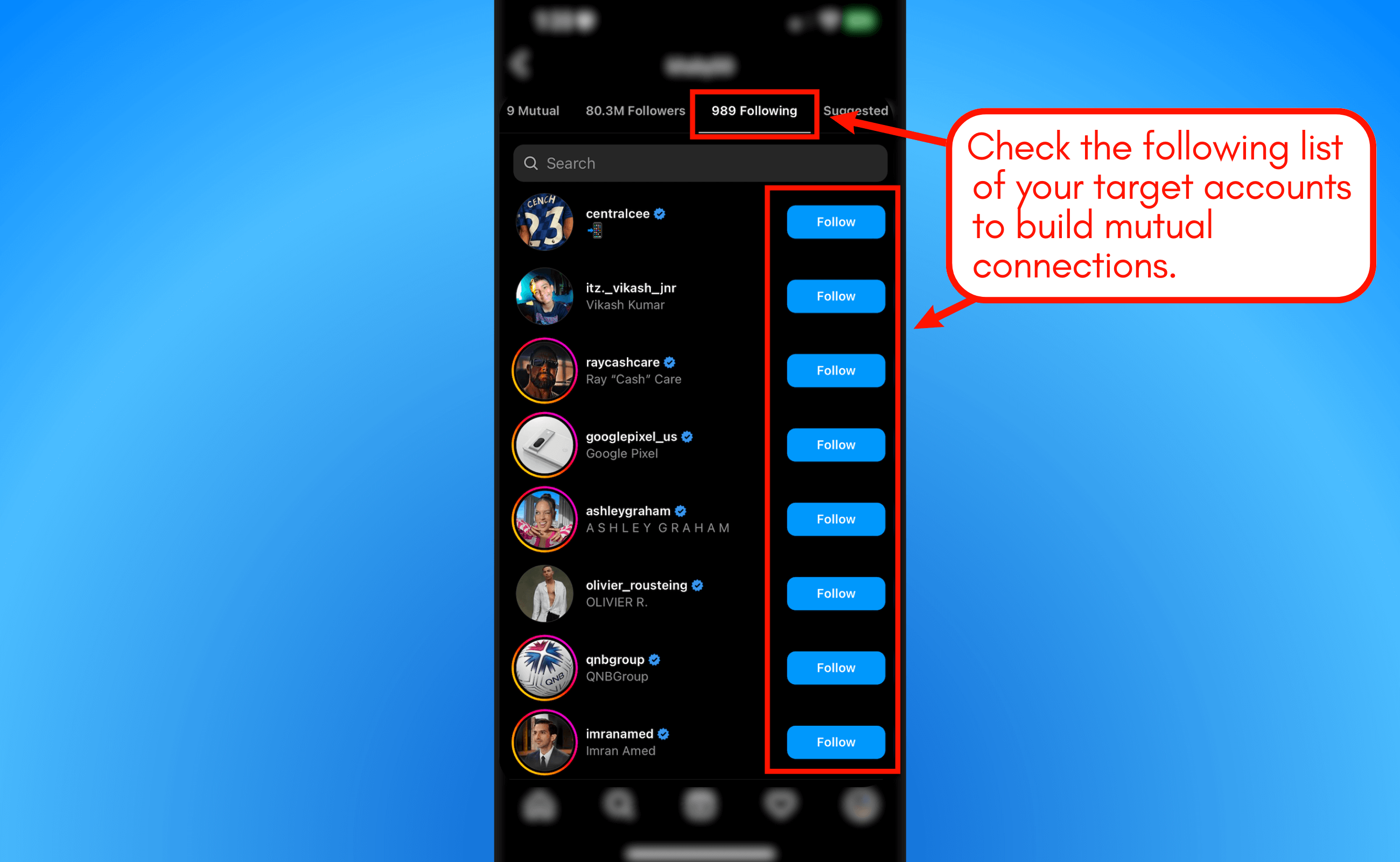

Source: calculatedself.com

Consider work with a financial advisor or join financial accountability groups where members support each other’s long term goals. Professional guidance can be specially valuable during major life transitions when lifestyle creep risks are highest.

Track your progress toward financial goals visually through charts, apps, or regular check ins. See concrete progress toward important objectives provide motivation to resist short term spending temptations that could derail long term success.

Long term wealth building despite income growth

Successfully avoid lifestyle creep enable powerful wealth build opportunities. As income grow while expenses remain control, the gap between earnings and spending create increase capacity for savings and investment. This grows surplus can accelerate progress toward financial independence and provide security during uncertain times.

Consider lifestyle creep prevention as pay your future self. Every dollar not spend on unnecessary upgrades today become multiple dollars of future wealth through compound growth. This perspective help frame spending decisions in terms of their long term opportunity costs instead than exactly immediate affordability.

Remember that true financial freedom come from have choices, not from consume at the highest level your income allow. Maintain some distance between your earning capacity and spending requirements preserve flexibility and reduce financial stress, finally provide more life satisfaction than constant lifestyle upgrades.