ITD in Finance: What Inception-to-Date Means, How to Use It, and Why It Matters

Overview: What ITD Means and Why It Matters

In finance,

ITD

typically stands for

Inception-to-Date

, which captures the

total activity from the start of a project, grant, fund, or contract through a specific date

. It is widely used for grants, contracts, and capital projects to show cumulative performance and spend since inception

[1]

. Some audit and controls teams also use ITD as shorthand for an

IT Dependency

-the system-generated reports or data relied on to perform controls, which must be validated for completeness and accuracy

[2]

. Many university and public-sector finance glossaries define ITD as the inception-to-date time frame, aligning with common project accounting practice

[3]

.

Because the same acronym appears in different contexts, the safest approach is to confirm the intended meaning-Inception-to-Date in budgeting/reporting, or IT Dependency in audits-before using it in policies, dashboards, or control narratives [1] [2] .

ITD (Inception-to-Date): Definition, Use Cases, and Benefits

Definition. Inception-to-Date (ITD) represents the cumulative total-actual and sometimes budgeted-since the very beginning of a project, fund, or contract up to a reporting date. It is especially common in grant management and capital project reporting to monitor lifetime spending and progress [1] [3] .

Benefits. Organizations rely on ITD to: (1) track lifetime performance versus original scope and budget; (2) assess whether funding, schedule, and deliverables remain aligned; (3) support sponsor reporting for grants and contracts; and (4) inform change control on capital projects. These cumulative insights complement period-based views and reduce the risk of misjudging long-running efforts based on a single month or year snapshot [1] [3] .

Key comparison.

ITD differs from

Month-to-Date (MTD)

and

Year-to-Date (YTD)

, which summarize activity within the current month or fiscal year, respectively, whereas ITD runs from the beginning of the initiative to the present date

[3]

.

Real-World Examples

Grant-funded research project. A university lab tracks an NIH grant with a four-year term. ITD actuals show cumulative spend on personnel, equipment, and subawards. By comparing ITD actuals to ITD budget, the grants office can spot burn-rate issues early and request rebudgeting if necessary [1] .

Capital construction. A health system monitors a new clinic build. ITD helps the PMO see total costs since ground-breaking-design, permitting, construction, owner’s contingency-so leadership evaluates contingency sufficiency and approves change orders with full-lifecycle visibility [3] .

Long-term customer contract. A software provider tracks a five-year enterprise contract. Finance reports ITD recognized revenue and costs versus total contract value to assess margins over the contract life and to manage renewals with historical context [1] .

How to Calculate ITD and Build Reliable Reports

Step 1-Define inception. For each project/grant/contract, formally define the inception date (e.g., award start, contract effective date, project authorization). Maintain this in your project master data or grant setup so reporting can key off the same anchor date [1] .

Step 2-Aggregate transactions. Pull all relevant actuals (expenses, revenues, transfers) from the inception date through the report date. Confirm that accruals and adjustments are included according to policy so the cumulative figure is complete and not double-counted [3] .

Step 3-Align to ITD budget. Where applicable, map ITD actuals against a cumulative budget baseline. Many grants and capital projects have total-life budgets; aligning them to the same time frame supports variance analysis and burn-rate monitoring [1] .

Step 4-Reconcile with period views. Tie ITD to YTD and MTD reports: ITD should equal prior-year ITD at prior fiscal year end plus current YTD, after accounting for any restatements. This reconciliation helps detect omissions or duplicate postings [3] .

Step 5-Document assumptions. Include notes on capitalization thresholds, accrual methodology, foreign exchange handling, and cut-off dates. Consistent documentation increases auditability and sponsor confidence [1] .

Common Challenges and Solutions

Challenge: Misaligned inception dates across systems. Solution: Establish a single system of record for project/grant master data and enforce change control for any retroactive inception date edits [1] .

Challenge: Double counting when rolling up multiple ledgers or data sources. Solution: Use unique project IDs, consistent posting rules, and reconciliation between ITD and period-based totals to detect duplicates [3] .

Challenge: Incomplete capture of commitments and encumbrances. Solution: Where sponsors require visibility into obligations, include encumbrance balances alongside ITD actuals with clear labeling and definitions [1] .

ITD in Audit and Controls: IT Dependency (ITD)

In audit practice, ITD can also refer to an IT Dependency -reports, queries, or exports that management relies on to perform a control. Auditors expect management to validate that the underlying information is complete and accurate. Without this validation, a key control may be deemed ineffective [2] .

Four common dependency types. Control performers typically rely on: (1) standard application reports; (2) third-party supported standard reports; (3) custom reports; and (4) ad-hoc queries. Each type has different risks and evidence expectations for change management, access, and data integrity [2] .

Validation objectives.

Management should demonstrate

completeness

(all relevant transactions included once) and

accuracy

(correct amounts, timing, and classifications). Evidence often includes report parameters, change logs, source-to-report reconciliations, and access controls over who can run or modify the report

[2]

.

Step-by-Step: Validating an IT Dependency

Step 1-Inventory dependencies. List all reports/queries used in SOX or key operational controls. Classify each into the four categories and note the owning system, parameters, frequency, and control owners [2] .

Step 2-Lock parameters and access. Document standard parameters (date ranges, entity, account filters). Restrict who can change them and who can access the underlying data and report definitions [2] .

Source: itd.no

Step 3-Test completeness and accuracy. Perform sample-based or full reconciliations from source transactions to the report output. Validate transformations, joins, and filters used in custom/ad-hoc reports [2] .

Step 4-Retain evidence. Keep parameter screenshots, report metadata, and reconciliation workpapers for the audit period. Establish a cadence to revalidate after system upgrades or configuration changes [2] .

Implementing ITD Reporting: Practical Steps and Alternatives

Practical setup. You can configure ITD reports in most ERP, EPM, or grant-management systems by enabling project/fund dimensions and cumulative time intelligence. If you cannot verify a direct vendor guide, consider searching your ERP’s official documentation for “project accounting ITD reporting,” “grant inception-to-date,” or “capital project cumulative spend.” Ensure your accounting policy defines when to use ITD versus YTD/MTD and how to present encumbrances [1] [3] .

Workflow example. For a new grant, accounting establishes the project ID and inception date; budgeting loads the total-life budget; AP and payroll code transactions to the project; reporting aggregates ITD actuals and compares to the ITD budget; the grants office reviews quarterly and communicates with the PI on burn rate and sponsor terms [1] .

Alternatives and complements. Where lifetime views are less relevant, YTD can be the primary lens for operational control with supplemental ITD for multiyear efforts. For rapidly changing initiatives, rolling 12-month and cumulative-to-target visualizations can complement ITD to show trajectory and seasonality [3] .

How to Communicate ITD to Stakeholders

Define terms on every report. Include a brief note: “ITD reflects cumulative activity since project inception.” Add the inception date and the report as-of date in headers for clarity [1] .

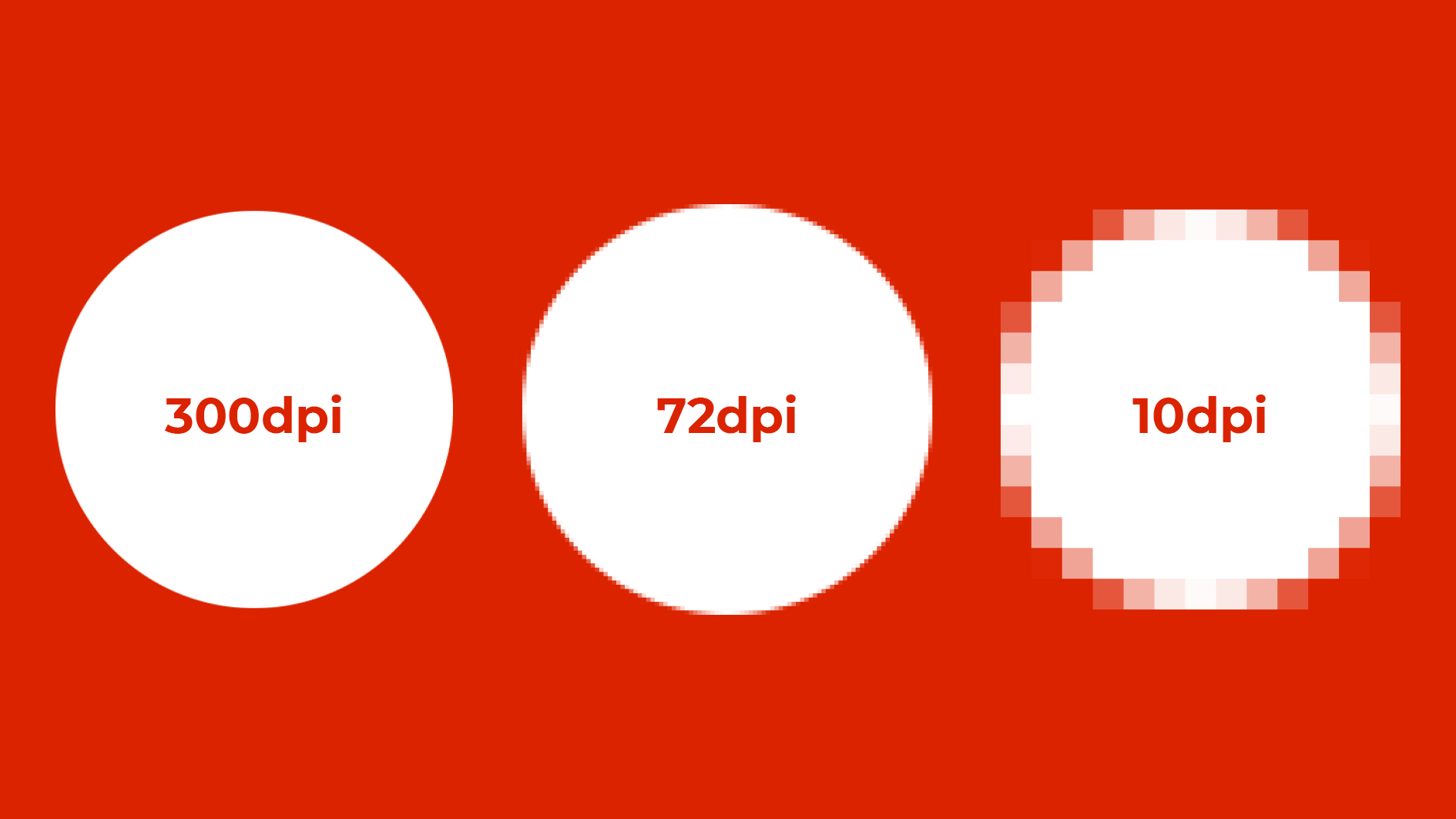

Pair with visual cues. Use progress bars for budget consumed ITD, and trend lines for month-by-month movement. For sponsors, place ITD next to remaining award funds and end date to frame urgency and compliance requirements [1] .

Address controls explicitly. If a control relies on a report output, label it as an IT dependency and include the validation summary (parameters locked, reconciliation performed, evidence stored) to satisfy audit expectations [2] .

Avoiding Common Misunderstandings

Ambiguity in the acronym. In finance operations, most teams mean Inception-to-Date by ITD; audit teams may mean IT Dependency. Clarify at the outset to reduce rework and audit comments [1] [2] .

Confusing ITD with tax terms. In some regions, HR/payroll may reference an “income tax declaration,” also abbreviated as ITD. If your context is payroll or individual tax planning, verify local terminology through official employer guidance or tax authority resources rather than assuming it matches project accounting usage [4] .

Action Steps You Can Take Now

1) Identify which meaning of ITD applies to your process-Inception-to-Date for reporting or IT Dependency for controls. 2) For project reporting, confirm inception dates and build an ITD vs. budget view. 3) For audit dependencies, inventory reports, lock parameters, and test completeness and accuracy. 4) Update your policy glossary to define ITD and include examples to standardize usage across finance, PMO, grants, and audit teams [1] [2] [3] .

References

[1] Cornell University (n.d.). What are inception-to-date (ITD) balances?

[2] AuditBoard (2022). IT Dependency (ITD) Validation Process Best Practices.

Source: apps.itd.co.th

[3] Texas Tech University Health Sciences Center (n.d.). Finance Reporting Terms.

[4] Tickertape (2021). What is income tax declaration (ITD)?