Car Financing After Repossession: Complete Guide to Getting Approved

Understand car financing after repossession

Get a car loan after experience a repossession can feel overwhelming, but it’s not impossible. Millions of Americans face this challenge each year, and many successfully secure financing for their next vehicle. The key lie in understand how repossession affect your credit profile and know which strategies work advantageously for your situation.

A repossession create a significant negative mark on your credit report, typically drop your credit score by 50 to 150 points. This mark remain visible to lenders for seven years, though its impact diminish over time. Despite this challenge, lenders who specialize in subprime auto loans regularly approve borrowers with repossessions on their credit history.

How repossession impact your credit and loan eligibility

When a lender repossess your vehicle, they report this action to all three major credit bureaus. The repossession appear as a separate negative item, distinct from any late payments that precede it. If the lender sells the vehicle for less than your remain loan balance, you may likewise face a deficiency judgment, which create additional negative marks.

Credit scoring models view repossession as a serious delinquency, similar to foreclosure or bankruptcy. Nonetheless, the impact varies base on your overall credit profile. Someone with antecedently excellent credit may see a more dramatic score drop than someone who already have multiple negative marks.

Source: dreamstime.com

Lenders evaluate repossession otherwise depend on several factors. The age of the repossession matter importantly – a three-year-old repo carry less weight than one from six months alone. The circumstances surround the repossession to influence lender decisions. Job loss or medical emergency explanations much receive more sympathy than voluntary surrender or chronic payment problems.

Timeline for getting approve after repossession

Most financial experts recommend wait at least six months after a repossession before apply for new auto financing. This wait period serve multiple purposes. Firstly, it allows your credit score to stabilize after the initial impact. Secondly, itgivese you time to demonstrate improve financial responsibility through other accounts.

The optimal timeline depends on your specific situation. If you pay off the deficiency balance promptly and maintain other accounts in good standing, you might qualify for financing shortly. Conversely, if the repossession was part of broader financial difficulties, wait retentive oftentimes result in better loan terms.

During this waiting period, focus on rebuild your credit profile. Pay all bills on time, reduce credit card balances, and avoid apply for unnecessary credit. These positive actions help offset the negative impact of the repossession.

Types of lenders who finance after repossession

Several categories of lenders specialize in help borrowers with repossessions obtain auto financing. Subprime auto lenders focus specifically on borrowers with damaged credit. These companies understand that past financial difficulties don’t inevitably predict future payment behavior.

Credit unions oftentimes provide more flexible underwriting than traditional banks. Many credit unions consider the whole person kinda than equitable credit scores. If you can join a credit union, they may offer better rates and terms than commercial subprime lenders.

Buy here pay dealerships represent another option, though they typically charge higher rates and offer less favorable terms. These dealers finance their own vehicles and may approve borrowers who ca n’can’tify elsewhere. Yet, research any dealer cautiously, as some engage in predatory lending practices.

Online lenders have expanded the subprime auto market importantly. These companies use sophisticated algorithms to evaluate risk beyond traditional credit scores. Some online lenders specialize in specific situations, include post repossession financing.

Required documentation and application process

Apply for auto financing after repossession require thorough documentation. Lenders want to see proof of income, employment stability, and current financial obligations. Gather recent pay stubs, tax returns, bank statements, and documentation of any other income sources.

Prepare a write explanation of the circumstances that lead to your repossession. Keep this explanation factual and brief, focus on what you’ve done to improve your financial situation since so. Lenders appreciate honesty and evidence of lessons learn.

Your debt to income ratio become peculiarly important after a repossession. Most subprime lenders prefer to see total monthly debt payments below 40 % of gross monthly income. This includes yourproposale car payment, then calculate cautiously before shopping.

Employment history carry extra weight in post repossession applications. Lenders prefer to see at least six months of stable employment, though some may accept shorter periods with adequate explanation. Self employ borrowers face additional documentation requirements, include profit and loss statements and business bank statements.

Down payment requirements and strategies

Down payments play a crucial role in post repossession financing. Most subprime lenders require larger down payments to offset the perceive risk. Expect to put down 10 % to 20 % of the vehicle’s value, though requirements vary by lender and your specific credit profile.

A larger down payment offer several advantages beyond meet lender requirements. It reduces your loan amount, lower monthly payments and total interest costs. It besides provide equity cushion, reduce the risk of become top down on the loan.

If save for a down payment seem challenge, consider several strategies. Sell items you nobelium retentive need, take on temporary additional work, or redirect money from discretionary spending. Some borrowers use tax refunds or bonuses to fund their down payment.

Trade-ins can supplement cash down payments, but be realistic about your vehicle’s value. Get appraisals from multiple sources before negotiate. Remember that dealers much offer less for trtrade-inshan private party sales, but the convenience may justify the difference.

Interest rates and loan terms to expect

Interest rates for post repossession auto loans typically range from 15 % to 25 %, importantly higher than prime rates. Your specific rate depend on factors include credit score, income, down payment, and loan term. Shop with multiple lenders help ensure you get the best available rate.

Loan terms for subprime borrowers oftentimes differ from prime loans. Some lenders prefer shorter terms to reduce their risk exposure, while others offer longer terms to lower monthly payments. Evaluate total interest costs, not fair monthly payments, when compare offers.

Avoid exceedingly long loan terms, yet if they lower your payment. Seven or eight year auto loans much result in negative equity situations where you owe more than the vehicle’s worth. This make trading or sell difficult and can lead to financial problems if the car need major repairs.

Some lenders offer rate reduction programs for borrowers who make timely payments. These programs can lower your interest rate after 12 or 24 months of on time payments. Ask about such programs when compare lenders.

Vehicle selection and age restrictions

Lenders who finance post repossession borrowers oftentimes impose restrictions on eligible vehicles. Many limit financing to vehicles less than 10 years old with fewer than 100,000 miles. These restrictions help protect the lender’s collateral value.

Focus on reliable, mainstream vehicles with good resale value. Avoid luxury cars, exotic vehicles, or models with poor reliability records. Lenders view these as higher risk and may decline financing or offer less favorable terms.

Consider certify pre own vehicles, which offer warranty protection and have undergone thorough inspections. The additional peace of mind may justify somewhat higher prices, and some lenders view certify vehicles morfavorablyly.

Get a pre-purchase inspection for any use vehicle you’re considered. This investment can save thousands if irevealsal hidden problems. Some lenders require inspections for older or higher mileage vehicles.

Build credit during your new auto loan

Your new auto loan provides an excellent opportunity to rebuild your credit profile. Make every payment on time, as payment history represent 35 % of your credit score. Set up automatic payments to ensure you ne’er miss a due date.

Consider make payments slimly betimes or round up to the nearest $25 or $$50 These strategies can save interest and demonstrate strong payment habits to future lenders. Yet, don’t sacrifice other financial goals to pay spare on a high rate auto loan.

Monitor your credit reports regularly to ensure the new loan appear aright. Dispute any errors now, as they can damage your rebuilding efforts. Many credit monitoring services are available free through credit card companies or financial institutions.

Avoid take on additional debt while rebuild your credit. Focus on manage your current obligations responsibly instead than add new accounts. This approach demonstrate financial discipline to future lenders.

Common mistakes to avoid

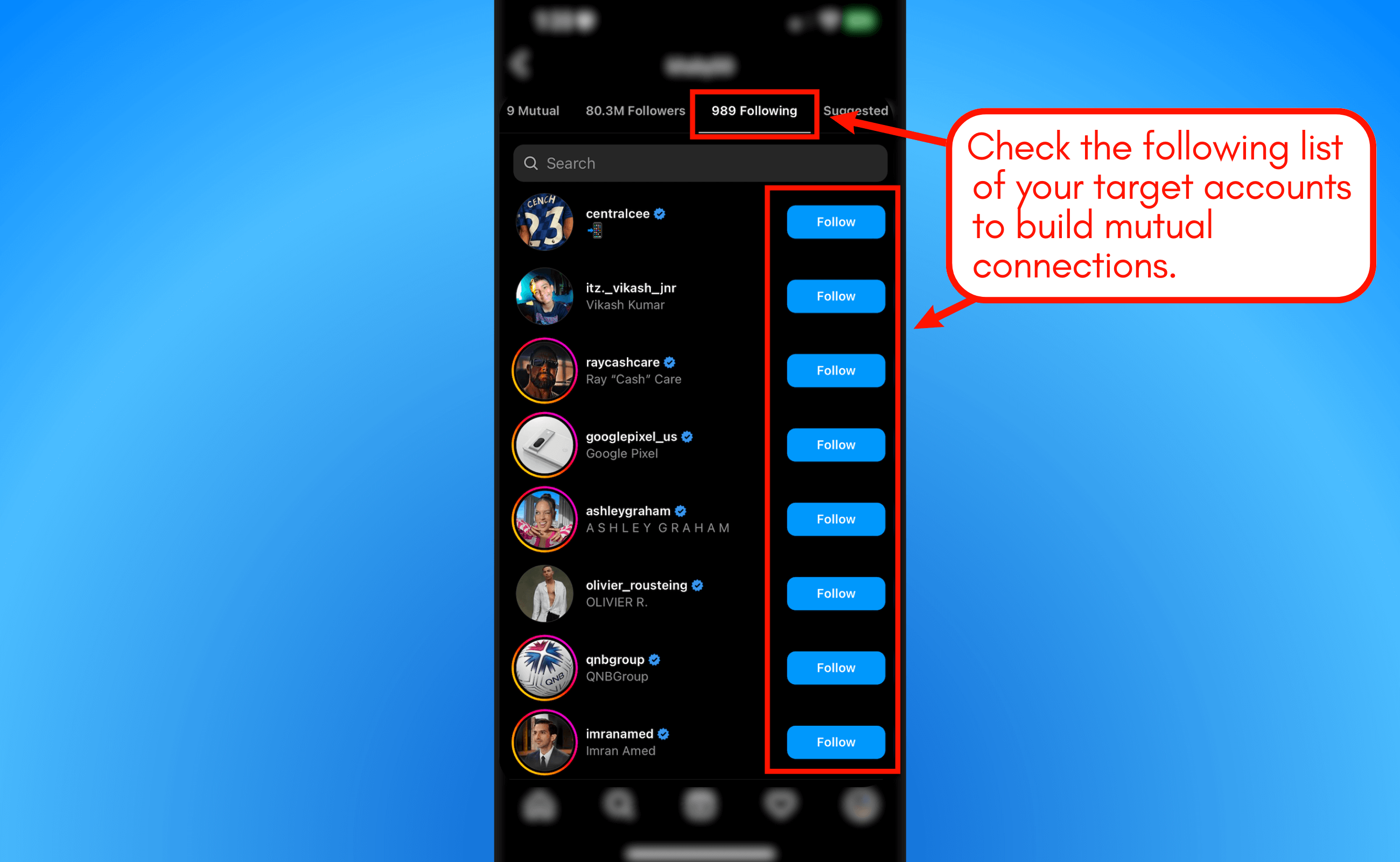

Many borrowers make costly mistakes when seek post repossession financing. Avoid apply with multiple lenders simultaneously, as this generate numerous credit inquiries that can lower your score. Alternatively, do your research firstly and apply strategically.

Don’t accept the first offer you receive without shop approximately. Subprime lending is competitive, and rates can vary importantly between lenders. Take time to compare at least three offers before make a decision.

Resist the temptation to buy more car than you need. Focus on reliable transportation preferably than status or luxury features. Remember that you’re rebuilt your financial foundation, not reward past mistakes.

Avoid dealers who pressure you to buy instantly or claim their offer expire promptly. Legitimate lenders provide reasonable time to consider their terms. High pressure tactics oftentimes indicate predatory lending practices.

Alternative transportation solutions

While work toward auto financing approval, consider alternative transportation options. Public transportation, ride sharing, or carpooling might meet your needs temporarily while you improve your credit profile.

Some employers offer transportation benefits or flexible work arrangements that reduce commuting needs. Work from home evening part-time can importantly reduce transportation requirements.

Consider purchase an inexpensive cash vehicle while rebuild your credit. A reliable older car can provide transportation without monthly payments, allow you to save for a larger down payment on your next finance vehicle.

Family loans represent another option, though they require careful consideration. If family members are willing and able to help, establish clear terms and stick to them sacredly. Mix family and money can strain relationships if not handle decently.

Long term financial recovery strategy

Getting approve for post repossession auto financing represent equitable one step in your broader financial recovery. Develop a comprehensive plan that address all aspects of your financial health, not exactly transportation needs.

Create and maintain a detailed budget that account for all income and expenses. Include your car payment, insurance, maintenance, and fuel costs in your transportation budget. Many borrowers underestimate the total cost of vehicle ownership.

Build an emergency fund to handle unexpected expenses without miss loan payments. Start with a goal of $1,000, so work toward three to six months of expenses. This fund provide crucial protection against future financial setbacks.

Source: yankodesign.com

Consider work with a nonprofit credit counseling agency to develop a comprehensive debt management plan. These organizations provide free or low-cost services to help you rebuild your financial foundation consistently.

Successfully obtain auto financing after a repossession require patience, preparation, and realistic expectations. While the process present challenges, thousands of borrowers navigate it successfully each year. Focus on demonstrate improve financial responsibility, shop cautiously for the best available terms, and use your new loan as a stepping stone toward complete financial recovery. With time and consistent effort, the repossession will become a distant memory sooner than a will continue obstacle to your financial goals.