Car Finance Credit Checks UK: Complete Guide to Approval Requirements

Understand car finance credit checks

When apply for car finance in the UK, lenders conduct comprehensive checks to assess your creditworthiness. These checks determine whether you qualify for financing and influence the terms you receive. Understand what lenders examine help you prepare advantageously and increase your chances of approval.

Car finance credit checks involve multiple layers of assessment. Lenders don’t fair look at your credit score they examine your entire financial profile to make informed lending decisions.

Types of credit checks for car finance

Soft credit checks

Soft credit checks provide initial assessments without affect your credit score. Many lenders use these for preliminary quotations and eligibility checks. These searches appear on your credit report but remain invisible to other lenders.

During soft checks, lenders review basic information like your credit score range and general payment history. This helps them determine whether to proceed with a full application.

Hard credit checks

Hard credit checks occur during formal applications and leave visible marks on your credit file. These comprehensive searches examine detailed financial information and can temporarily lower your credit score by a few points.

Lenders perform hard checks when you submit complete applications with support documentation. Multiple hard searches within short periods can negatively impact your credit rating.

What information lenders examine

Credit history analysis

Lenders scrutinize your payment history across all credit accounts. They look for patterns of late payments, miss payments, and defaults. Recent payment behavior carry more weight than older issues.

Your credit mix likewise matter. Lenders prefer see responsible management of different credit types, include credit cards, loans, and mortgages. This demonstrates your ability to handle various financial commitments.

Income and employment verification

Stable employment history strengthen your application importantly. Lenders typically require at least three months in your current role, though some prefer longer employment periods.

Income verification involve examine payslips, bank statements, and employment contracts. Self employ applicants face additional scrutiny and may need to provide tax returns or accountant statements.

Debt to income ratio assessment

Lenders calculate your debt to income ratio to ensure you can afford new payments. This includes exist credit commitments, mortgage payments, and other financial obligations.

Most lenders prefer debt to income ratios below 40 50 %. Higher ratios may result in rejection or require larger deposits to secure financing.

Electoral roll and address verification

Electoral roll registration importantly impacts your credit application. Lenders use this information to verify your identity and address history. Unregistered applicants oftentimes face automatic rejection.

Address stability to influence lending decisions. Frequent moves within short periods may raise concerns about your reliability. Lenders prefer applicants with stable residential history.

Affordability assessments

Income and expenditure analysis

Lenders conduct detailed affordability assessments examine your monthly income against regular expenses. This includes rent or mortgage payments, utility bills, insurance, and living costs.

Recent regulatory changes require lenders to verify affordability more soundly. They may request bank statements show several months of transactions to understand your spending patterns.

Future financial commitments

Lenders consider upcoming financial changes that might affect your ability to repay. This includes plan career changes, upcoming expenses, or changes in family circumstances.

Source: smallbizclub.com

Be honest about future commitments during applications. Lenders appreciate transparency and may work with you to find suitable solutions.

Credit score requirements

Prime lending criteria

Prime lenders typically require credit scores above 700 for their best rates. These lenders offer competitive interest rates and favorable terms to applicants with excellent credit histories.

Prime lending to require stable employment, substantial income, and low debt to income ratios. Meet these criteria open access to manufacturer financing deals and promotional rates.

Close prime and subprime options

Near prime lenders work with credit scores between 600 700, though rates are typically higher. These lenders may require larger deposits or shorter loan terms.

Subprime lenders specialize in poor credit applications, accept scores below 600. While approval rates are higher, interest rates can be importantly elevate.

Documentation requirements

Essential documents

Standard applications require photo identification, recent payslips, and bank statements. Some lenders request utility bills or council tax statements for address verification.

Employment verification may involve contact your employer direct. Prepare your hr department for potential calls from finance companies.

Additional documentation

Self employ applicants need comprehensive financial documentation, include tax returns, business accounts, and accountant statements. This process typically takes longer than employ applications.

Applicants with complex financial situations may need additional documentation explain income sources, investment returns, or pension payments.

Common reasons for rejection

Credit relate issues

Recent defaults, CCS, or bankruptcy importantly impact approval chances. Nonetheless, time help heal credit problems, and some lenders specialize in adverse credit situations.

High credit utilization ratios besides concern lenders. Use large percentages of available credit suggest financial stress and increase rejection risk.

Affordability concerns

Insufficient income relative to the request loan amount usually lead to rejection. Lenders must ensure you can well afford payments alongside exist commitments.

Irregular income patterns, peculiarly for self employ applicants, may result in rejection from traditional lenders. Specialist lenders substantially understand variable income situations.

Improve your approval chances

Credit score enhancement

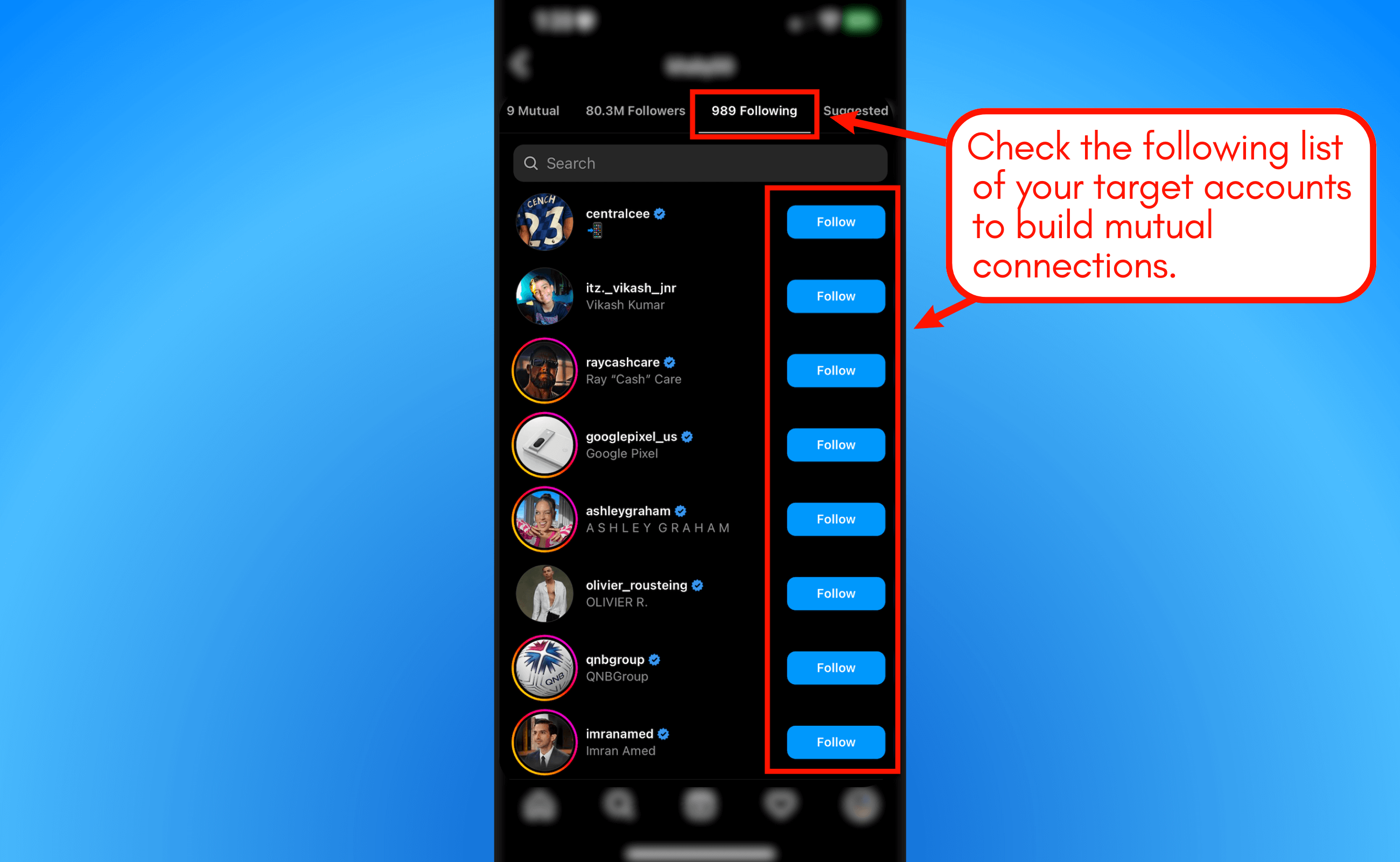

Register on the electoral roll instantly if you haven’t already. This simple step importantly improves your credit profile and approval chances.

Pay down exist credit balances to improve utilization ratios. Aim to use less than 30 % of available credit limits across all accounts.

Application timing

Avoid multiple credit applications within short periods. Space applications at least one month isolated to minimize credit score impact.

Time applications strategically around pay dates when bank balances look strongest. This presents your financial position morefavorablyy.

Specialist lenders and alternative options

Bad credit specialists

Specialist lenders focus on adverse credit situations and understand complex financial circumstances. They oftentimes approve applications reject by mainstream lenders.

These lenders may require larger deposits or offer shorter loan terms, but they provide valuable financing options for credit impair applicants.

Guarantor finance

Guarantor loans involve a creditworthy person guarantee your payments. This option help applicants with poor credit access better rates and terms.

Choose guarantors cautiously, as they become lawfully responsible for payments if you default. This arrangement affect both parties’ credit files.

Post application process

Decision timeframes

Most lenders provide initial decisions within hours or days. Complex applications involve manual underwriting may take retentive.

Automated systems handle straightforward applications promptly, while unusual circumstances require human review and extended processing times.

Conditional approvals

Conditional approvals require additional documentation or verification before final confirmation. Common conditions include income verification or deposit confirmation.

Source: investopedia.com

Respond to conditional approval requests quickly to avoid delays or potential withdrawal of offers.

Understand your rights

You have the right to know why applications are rejected and can request detailed explanations from lenders. This information help improve future applications.

Credit reference agencies must provide free credit reports yearly, help you monitor your credit file and identify potential issues before apply.

If you believe credit file information is incorrect, you can dispute entries with credit reference agencies. Successful disputes improve your credit profile and future application prospects.