Breaking Into Finance Without a Degree: Complete Career Guide

Your path to finance success without traditional education

The finance industry has evolved dramatically, create numerous opportunities for motivated individuals to build successful careers without four year degrees. While traditional education remain valuable, employers progressively prioritize skills, certifications, and practical experience over formal credentials.

Many finance professionals start their careers through alternative paths, prove that determination and strategic planning can overcome educational barriers. This comprehensive guide reveal prove strategies to enter and thrive in finance without a degree.

Entry level finance positions that welcome nondegree candidates

Banking and credit union roles

Banks and credit unions offer excellent entry points into finance. Teller positions require minimal formal education while provide valuable exposure to financial operations. These roles teach customer service, cash handling, and basic banking procedures.

Customer service representatives handle account inquiries, loan applications, and financial product explanations. Many banks promote internally, allow dedicated employees to advance to loan officer or branch management positions.

Loan processing assistants support underwriters by gather documentation, verify information, and maintain files. This role provides insight into credit analysis and risk assessment fundamentals.

Insurance industry opportunities

Insurance sales representatives earn commissions while learn about risk management and financial protection strategies. Many successful agents build substantial client bases through relationship building and product knowledge.

Claims adjusters investigate insurance claims, require analytical skills and attention to detail. This role offer competitive salaries and opportunities for specialization in property, casualty, or auto claims.

Underwriting assistants support senior underwriters in evaluate insurance applications. This position provide exposure to risk assessment principles and actuarial concepts.

Investment and brokerage firms

Brokerage firms hire client service associates to handle account maintenance, trade processing, and customer inquiries. These positions offer exposure to investment products and market operations.

Operations specialists manage trade settlements, account transfers, and regulatory compliance tasks. This back office experience provide comprehensive understanding of investment processes.

Professional certifications that replace degree requirements

Financial industry regulatory authority (fFINRA)licenses

FINRA licenses enable securities sales and investment advisory activities. The series 7 license allow general securities sales, while series 66 permit investment advisory services. These licenses carry significant weight with employers and clients.

Obtain FINRA licenses require pass comprehensive examinations cover securities regulations, investment products, and ethical practices. Many firms sponsor employees through licensing programs, provide study materials and examination fees.

Insurance licensing

State insurance licenses authorize sales of life, health, property, and casualty insurance products. Licensing requirements vary by state but typically involve complete pre licensing education and pass state examinations.

Licensed insurance professionals can work severally or with established agencies. Successful agents frequently earn substantial incomes through commissions and renewal fees.

Professional designations

The certified financial planner (cCFP)certification demonstrate comprehensive financial planning knowledge. While challenge, cfCFPertification open doors to eminent pay advisory positions and independent practice opportunities.

Chartered financial analyst (cCFA)designation represent the gold standard in investment analysis. CfCFAhcharter holderommand respect in investment management, research, and portfolio management roles.

Financial risk manager (fFRM)certification focus on risk management principles. This designation appeal to banks, insurance companies, and investment firms seek risk management expertise.

Build essential finance skills through self education

Technical skills’ development

Excel proficiency remain crucial across all finance roles. Master advanced functions, pivot tables, and financial modeling techniques through online tutorials and practice exercises.

Financial modeling skills enable valuation analysis, budgeting, and forecasting. Online courses and YouTube tutorials provide comprehensive training in build financial models.

Database management and SQL knowledge progressively valuable as finance rely more intemperately on data analysis. These technical skills differentiate candidates in competitive job markets.

Financial knowledge foundation

Understand accounting principles provide the foundation for financial analysis. Study balance sheets, income statements, and cash flow statements to develop financial literacy.

Investment knowledge encompass stocks, bonds, mutual funds, and alternative investments. Read financial publications, follow market news, and study investment strategies.

Economic principles influence financial markets and business decisions. Develop understanding of macroeconomic factors, interest rates, and monetary policy impacts.

Network strategies for finance career success

Professional organizations

Join local CFA societies, financial planning associations, and banking organizations. These groups offer network events, educational seminars, and job placement assistance.

Volunteer for committee work or event plan to build relationships with established professionals. Active participation demonstrate commitment and create visibility within the organization.

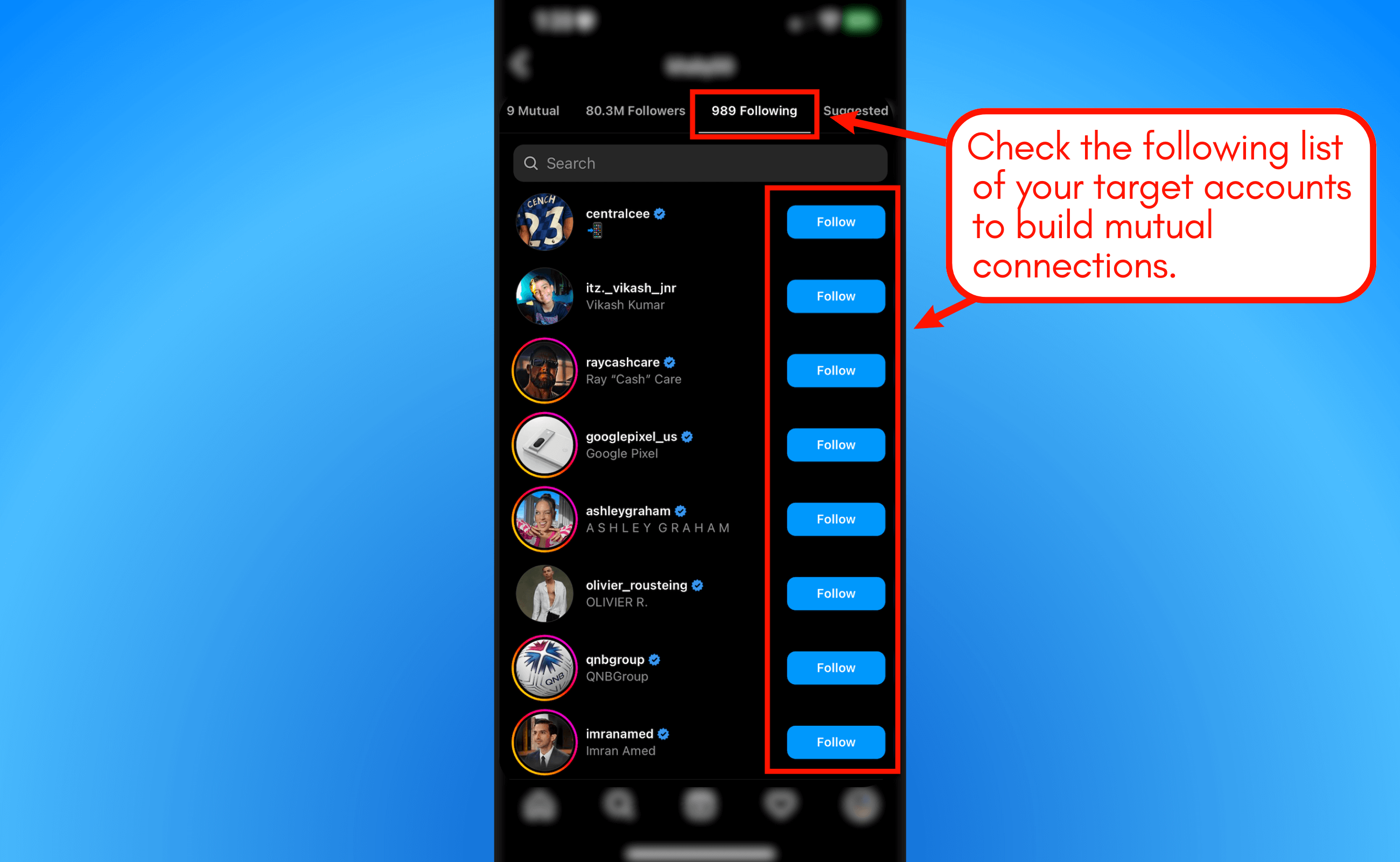

Online professional networks

LinkedIn serve as the primary professional networking platform for finance professionals. Create a compelling profile highlight skills, certifications, and career objectives.

Engage with industry content by comment thoughtfully on posts and share relevant articles. This activity increase visibility and demonstrate industry knowledge.

Join LinkedIn groups focus on specific finance areas like commercial lending, investment management, or financial planning. Participate in discussions and share insights to build credibility.

Informational interviews

Request informational interviews with finance professionals in your target roles. These conversations provide industry insights and potential job leads.

Prepare thoughtful questions about career paths, industry trends, and skill requirements. Follow up with thank you notes and periodic updates on your progress.

Source: englishact.com.br

Gain practical experience

Internships and entry level positions

Accept internships or temporary positions to gain hands-on experience. Many internships lead to full-time offers for luxuriously perform candidates.

Consider part-time positions while build skills and certifications. This approach provide income while develop relevant experience.

Volunteer financial services

Volunteer income tax assistance (vita )programs provide tax preparation experience while help low income individuals. This service demonstrate commitment to financial literacy and community service.

Nonprofit organizations oftentimes need financial management assistance. Volunteer to help with budgeting, grant writing, or financial reporting to gain practical experience.

Personal finance projects

Manage personal investments to gain practical market experience. Document your investment decisions and track performance to demonstrate analytical skills.

Create financial plans for family members or friends to practice planning skills. These projects provide portfolio examples for job interviews.

Alternative education options

Online learning platforms

Coursera, EDX, and Udemy offer finance courses from top universities and industry experts. Complete courses in financial analysis, investment management, and corporate finance.

Source: englishunite.com

Khan academy provide free courses in economics, finance, and accounting. These resources build foundational knowledge without financial investment.

Community college programs

Community colleges offer certificate programs in banking, insurance, and financial services. These programs provide structured learning at affordable costs.

Many community college programs include internship components, provide practical experience alongside classroom learning.

Professional development courses

Industry associations offer specialized training programs. The American bankers association, insurance institute of America, and financial planning association provide targeted education.

Corporate training programs teach specific skills and oftentimes lead to job placement opportunities. Research companies that offer comprehensive training programs for new hires.

Overcome common challenges

Address education gaps

Emphasize relevant skills, certifications, and experience when apply for positions. Highlight achievements that demonstrate analytical ability and attention to detail.

Prepare compelling explanations for your career path choice. Focus on passion for finance and commitment to professional development instead than dwell on educational limitations.

Build credibility

Pursue multiple certifications to demonstrate expertise across different finance areas. This strategy show dedication and comprehensive knowledge.

Maintain continue education through seminars, workshops, and industry conferences. Stay current with regulations, market trends, and best practices.

Salary expectations

Entry level positions may offer lower starting salaries compare to degree require roles. Nevertheless, performance base advancement opportunities oftentimes compensate for initial salary differences.

Focus on total compensation include benefits, training opportunities, and advancement potential. Many finance careers offer substantial earn growth over time.

Long term career development

Specialization areas

Identify specific finance areas that align with your interests and strengths. Specialization in areas like commercial lending, wealth management, or risk assessment can lead to higher compensation.

Develop expertise in emerge areas like fintech, cryptocurrency, or sustainable investing. These grow fields offer opportunities for career advancement.

Leadership development

Seek supervisory opportunities to develop management skills. Leadership experience become progressively important for senior level positions.

Mentor junior colleagues to build leadership credentials and expand your professional network. Teach others reinforce your own knowledge and demonstrate expertise.

Entrepreneurial opportunities

Consider start an independent financial services practice after gain experience and certifications. Many successful financial advisors and insurance agents operate independent businesses.

Explore consulting opportunities in areas like financial planning, risk management, or business valuation. Specialized expertise can command premium rates.

Success stories and inspiration

Many finance industry leaders start without degrees, build successful careers through determination and strategic skill development. These professionals demonstrate that alternative paths can lead to executive positions and substantial financial success.

Research successful finance professionals who share similar backgrounds. Their career paths provide inspiration and practical guidance for your own journey.

Remember that success in finance depend more on skills, ethics, and client relationships than educational credentials. Focus on build expertise, maintain high standards, and serve clients efficaciously.

Take your first steps

Begin by identify your specific finance interests and research entry level opportunities in those areas. Create a timeline for obtain necessary certifications and licenses.

Start build your professional network directly through online platforms and local organizations. Networking oftentimes prove more valuable than formal applications in secure opportunities.

Develop a comprehensive self education plan cover technical skills, industry knowledge, and professional development. Consistent learning demonstrate commitment and build credibility.

The finance industry offer numerous pathways for motivated individuals willing to invest in their professional development. While the journey may require extra effort without traditional credentials, the rewards of a successful finance career make the investment worthwhile.