American First Finance Credit Reporting: Complete Guide to Building Your Credit Score

Understand American first finance credit reporting

American first finance serve as a retail finance company that partner with numerous merchants across the United States to provide point of sale financing options. Many consumers wonder whether their payment history with American first finance impact their credit scores and appear on their credit reports.

The company principally focuses on provide financing solutions for furniture, electronics, automotive services, and other retail purchases. Unlike traditional credit cards or personal loans, retail financing arrangements oftentimes have different credit reporting practices that consumers should understand before make financing decisions.

Credit reporting practices explain

American first finance typically reports payment activity to major credit bureaus, includeExperiann,Equifaxx, andTransUnionn. This mean that both positive and negative payment behaviors can potentially affect your credit score. Notwithstanding, the specific reporting practices may vary depend on the type of financing agreement and the merchant partnership.

Positive payment history with American first finance can help build your credit profile over time. Make payments on schedule demonstrate responsible credit management to future lenders. Conversely, miss payments, late payments, or defaults may negatively impact your credit score and remain on your credit report for several years.

The company loosely reports accounts as installment loans kinda than revolve credit. This distinction matter because credit scoring models evaluate different types of credit accounts otherwise. Installment loans can contribute to credit mix diversity, which represent a factor in credit score calculations.

How retail financing affect your credit profile

When you apply for financing through American first finance, the company typically performs a credit check. This inquiry may appear as a hard pull on your credit report, potentially cause a temporary decrease in your credit score. Multiple credit inquiries within a short timeframe can compound this effect.

Formerly approve, the financing account become part of your credit history. The account will show your credit limit or loan amount, current balance, payment history, and account status. Credit utilization ratios and payment patterns on this account contribute to your overall credit profile assessment.

Retail financing accounts oftentimes have shorter terms compare to traditional loans. This mean you may pay off the balance comparatively quick, which can positively impact your credit utilization ratios. Nonetheless, close the account upon payoff may likewise reduce your total available credit, potentially affect your credit utilization calculations.

Build credit through responsible use

Consumers can leverage American first finance account to build positive credit history by follow several key strategies. Make all payments on time represent the almost crucial factor, as payment history account for the largest portion of most credit scoring models.

Set up automatic payments can help ensure you ne’er miss due dates. Many consumers find success by scheduling payments for a few days before the due date to account for processing time. This approach minimize the risk of late payments that could damage your credit score.

Pay more than the minimum require amount can help reduce your balance profligate and demonstrate strong financial management. Nonetheless, avoid pay off the entire balance now if your goal is build credit history, as some payment history over time provide more comprehensive credit profile information.

Monitor your credit reports regularly help ensure that American first finance report your account information accurately. Errors in credit reporting can negatively impact your score, hence identify and dispute inaccuracies quick protect your credit profile.

Potential credit score impact

The impact of American first finance account on your credit score depend on various factors include your exist credit profile, payment behavior, and overall credit management practices. Consumers with limited credit history may see more significant positive effects from responsible account management.

New accounts initially may cause a slight decrease in your average account age, which can temporarily lower your credit score. Nonetheless, consistent positive payment history typically outweighs this initial impact over time. The key lie in maintain responsible payment habits throughout the finance term.

Credit scoring models to consider credit mix, which include have different types of credit accounts. Add an installment loan through aAmericanfirst finance to a credit profile that antecedently exclusively include credit cards can potentially improve your credit mix factor.

Nonetheless, consumers should avoid open multiple financing accounts simultaneously, as this can indicate financial stress to lenders and negatively impact credit scores through multiple hard inquiries and increase debt obligations.

Compare retail financing to other credit options

American first finance offer an alternative to traditional credit cards for retail purchases, but consumers should understand how these options compare in terms of credit building potential. Credit cards typically offer more flexibility in payment amounts and usage, while installment loans provide structured payment schedules.

Interest rates and fees may differ importantly between retail financing and traditional credit options. Some American first finance arrangements offer promotional periods with reduced or zero interest rates, make them attractive for specific purchases. Yet, understand the terms after promotional periods end is crucial for make informed decisions.

Credit cards mostly provide ongoing credit building opportunities through regular use and payment, while installment loans offer credit building benefits mainly through consistent payment history over the loan term. Both can contribute positively to your credit profile when manage responsibly.

Manage multiple credit accounts

Consumers who use American first finance alongside other credit accounts need strategies for manage multiple credit obligations efficaciously. Create a comprehensive budget that account for all credit payments help ensure you can meet all obligations on time.

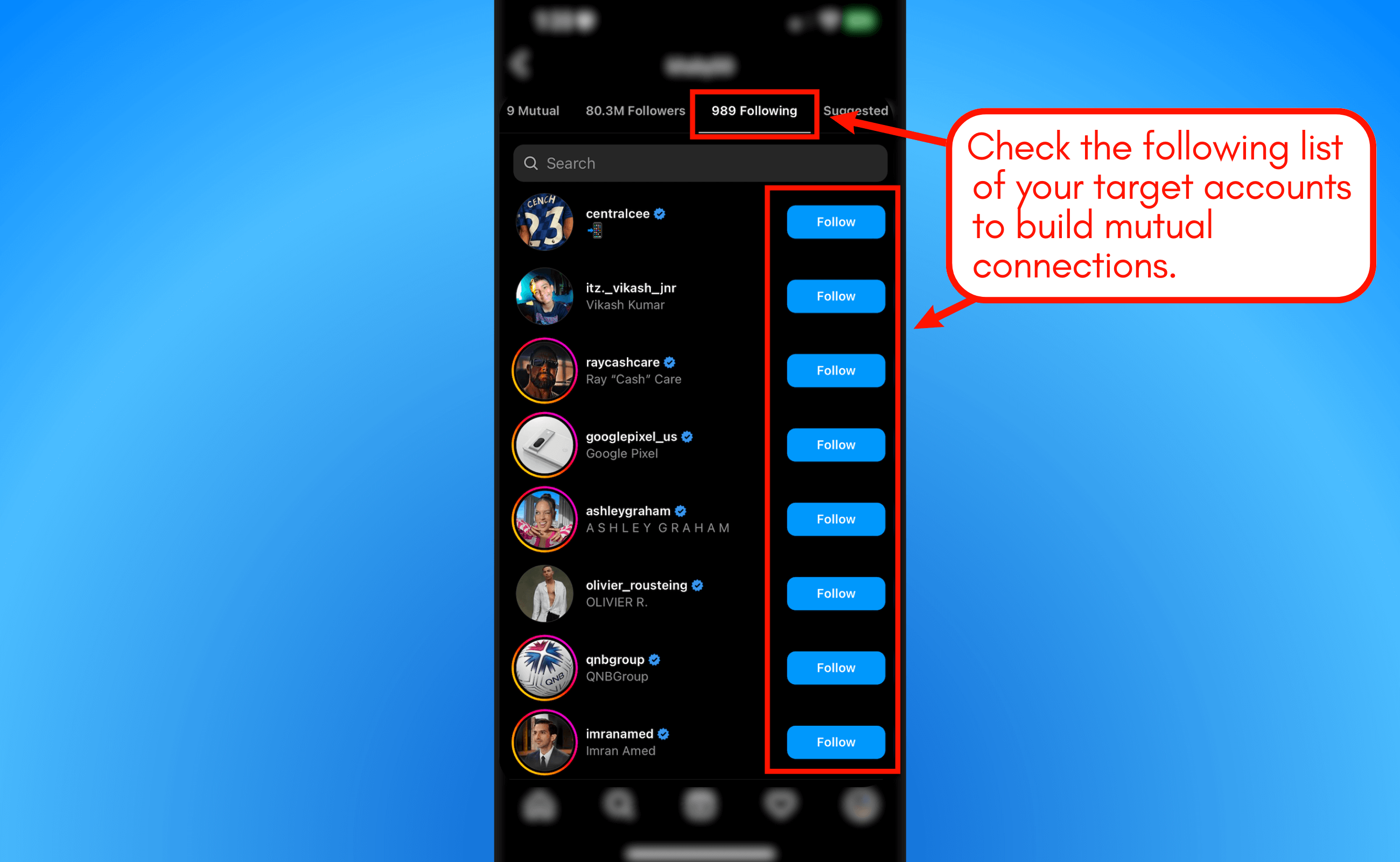

Source: YouTube.com

Organize payment due dates can prevent confusion and miss payments. Some consumers find success in consolidate due dates or create payment calendars that intelligibly outline all credit obligations. This systematic approach reduce the likelihood of overlook payments that could damage your credit score.

Maintain low overall credit utilization across all accounts demonstrate responsible credit management. Yet if you pay off your American first finance account responsibly, high balances on credit cards can yet negatively impact your credit score.

Common mistakes to avoid

Several common mistakes can undermine the credit building potential of American first finance accounts. Apply for financing without understand the terms, include interest rates, fees, and report practices, can lead to unexpected negative consequences for your credit profile.

Miss payments represent the virtually damaging mistake consumers can make. Yet one late payment can importantly impact your credit score and remain on your credit report for years. Set up payment reminders or automatic payments help prevent this costly error.

Ignore account statements and fail to monitor your credit reports can allow errors to persist unchallenged. Regular review of both your American first finance statements and credit reports help identify issues before they importantly impact your credit score.

Use retail financing for purchases you can not afford to represent another critical mistake. While financing can help build credit, take on debt beyond your ability to repay can lead to defaults that gravely damage your credit profile.

Long term credit building strategy

American first finance accounts can serve as components of a broader credit building strategy kinda than standalone solutions. Combine responsible management of retail financing with other positive credit behaviors create a comprehensive approach to credit improvement.

Diversify your credit profile with different account types, maintain low credit utilization ratios, and systematically make payments on time across all accounts demonstrate comprehensive financial responsibility to lenders. This holistic approach typically yield better long term credit score improvements.

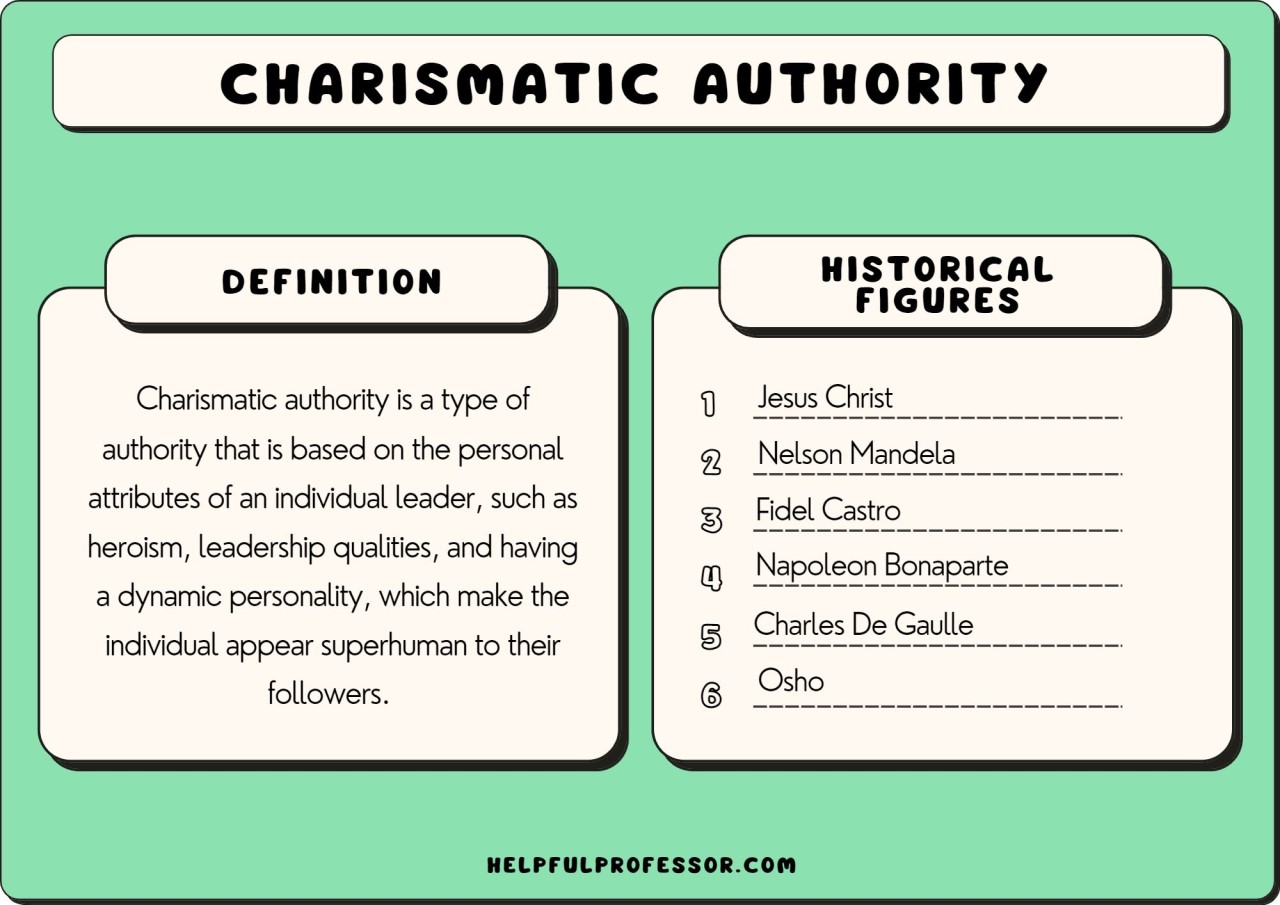

Source: pinterest.com

Plan for account closure upon payoff is important for maintaining your credit profile. While pay off debt is positive, closing accounts can affect your credit utilization ratios and average account age. Understand these impacts help you make informed decisions about account management.

Regularly review your credit reports and scores helps track progress and identify areas for improvement. Many consumers find that responsible management of retail financing accounts like those offer by American first finance contribute meaningfully to their overall credit building efforts when combine with other positive financial behaviors.

Build excellent credit require patience, consistency, and strategic thinking. American first finance accounts can provide valuable opportunities for credit building when manage responsibly as part of a comprehensive financial strategy focus on long term credit health and financial stability.