Alternative Financing Solutions: Complete Guide to Non-Traditional Funding Options

Understand alternative financing in today’s market

Traditional bank loans don’t invariably fit every financial need. Whether you’re look to purchase recreational vehicles, invest in specialized equipment, fund personal procedures, or grow your business, alternative financing options have expanded dramatically. These non-traditional funding sources offer flexibility and accessibility that conventional lending oftentimes can not provide.

The financing landscape has evolved to accommodate diverse needs, from individual purchases to business investments. Understand your options help you make informed decisions about funding strategies that align with your specific situation and financial goals.

Finance recreational vehicles and boats

Recreational vehicle financing require specialized knowledge of depreciation patterns, seasonal markets, and collateral considerations. Trailers and boats represent unique financing challenges due to their classification as luxury items kinda than necessities.

Trailer financing fundamentals

Trailer financing typically involves secured loans where the trailer serve as collateral. Lenders evaluate factors include trailer type, age, condition, and intend use. Travel trailers, utility trailers, and specialty haulers each have different financing terms and requirements.

Credit unions oftentimes provide competitive rates for trailer financing, sometimes offer better terms than traditional banks. Many dealerships besides provide in house financing or work with specialized lenders who understand the recreational vehicle market.

Down payment requirements normally range from 10 % to 20 % of the trailer’s value. Loan terms can extend from three to fifteen years, depend on the trailer’s value and your creditworthiness. Interest rates vary base on whether you’re purchase new or used equipment.

Private seller boat financing

Purchase a boat from a private seller present unique financing challenges since many lenders prefer work straightaway with dealers. Notwithstanding, several financing options exist for private party boat purchases.

Source: keystonemediahq.com

Marine lenders specialize in boat financing and oftentimes work with private sales. These lenders understand boat values, seasonal market fluctuations, and the importance of marine surveys in determine vessel condition and worth.

Personal loans can finance smaller boats, though interest rates may be higher than secured marine loans. Credit unions oftentimes offer marine financing with competitive rates, particularly for members with established relationships.

The financing process for private boat sales requires additional documentation, include bill of sale, marine survey, and sometimes coast guard documentation or state registration. Lenders typically require boats to besurveyedy by certify marine surveyors to establish current market value and identify potential issues.

Pre-approval help streamline private boat purchases by establish your budget and demonstrate serious intent to sellers. Many private sellers prefer buyers with financing already arrange, as it reduce transaction complexity and uncertainty.

Medical procedure financing

Cosmetic surgery financing has become progressively accessible through specialized medical financing companies and flexible payment programs. These procedures, typically not cover by insurance, require alternative funding approaches.

Medical financing companies

Dedicated medical financing companies offer loans specifically design for cosmetic procedures. These lenders understand the medical industry and oft provide promotional financing options, include defer interest periods.

Application processes are typically streamline, with many companies offer instant approval decisions. Loan amounts can range from small procedures cost a few thousand dollars to comprehensive treatments exceed $50,000.

Interest rates vary importantly base on creditworthiness and promotional offerings. Some companies provide zero percent financing for qualified applicants during promotional periods, while others offer extended payment terms to reduce monthly obligations.

Alternative medical financing options

Personal loans from banks or online lenders can finance cosmetic procedures, oftentimes with fix interest rates and predictable payment schedules. Credit cards, especially those with promotional rates, may work for smaller procedures.

Some practitioners offer in house payment plans, allow patients to pay direct over time. Healthcare credit cards design specifically for medical expenses provide another option, though terms and conditions vary wide.

Home equity loans or lines of credit can provide lower interest rates for significant procedures, use your home’s equity as collateral. Nonetheless, this approach requires careful consideration of the risks involve in secure medical expenses against your primary residence.

Business investment financing

Business financing encompass both acquire exist operations and funding growth initiatives. Each approach require different strategies and considerations.

Laundromat investment financing

Laundromat financing combine real estate and business equipment considerations. These businesses require substantial upfront investment but offer comparatively stable cash flows erstwhile establish.

SBA loans oftentimes provide favorable terms for laundromat purchases, peculiarly when real estate is included. These government back loans offer competitive rates and extend repayment terms, make them attractive for substantial investments.

Equipment financing can cover washers, dryers, and related machinery. Many equipment lenders specialize in commercial laundry equipment and understand the industry’s cash flow patterns and equipment lifecycles.

Seller financing sometimes plays a role in laundromat transactions, peculiarly when owners areretirede and willing to accept payments over time. This arrangement can benefit both parties by provide steady income for sellers while reduce upfront costs for buyers.

Cash flow analysis become crucial in laundromat financing, as lenders evaluate the business’s ability to service debt while provide adequate owner income. Location, competition, and demographic factors all influence financing decisions.

Business growth financing

Exist businesses have numerous options for finance expansion, each with distinct advantages and requirements. Growth financing strategies should align with business objectives and cash flow capabilities.

Traditional bank loans remain popular for establish businesses with strong credit histories and collateral. These loans typically offer competitive rates but require extensive documentation and lengthy approval processes.

Business lines of credit provide flexibility for ongoing growth needs, allow businesses to borrow against establish credit limits as need. This approach work wellspring for seasonal businesses or those with fluctuate capital requirements.

Equipment financing enable businesses to acquire machinery, vehicles, or technology while use the purchase items as collateral. This approach oft requires smaller down payments and offer tax advantages through depreciation.

Invoice factor converts outstanding receivables into immediate cash, provide work capital without traditional debt obligations. This option work peculiarly advantageously for businesses with reliable customers but extend payment terms.

Alternative lenders, include online platforms, offer faster approval processes and more flexible qualification criteria. While interest rates may be higher, these lenders oftentimes serve businesses that don’t meet traditional banking requirements.

Preparation and application strategies

Successful alternative financing require thorough preparation and understanding of lender expectations. Documentation, credit preparation, and realistic budgeting form the foundation of effective financing applications.

Documentation requirements

Different financing types require specific documentation packages. Recreational vehicle financing need vehicle identification numbers, condition assessments, and insurance information. Medical financing may require treatment plans and provider information.

Business financing demand comprehensive financial statements, tax returns, business plans, and cash flow projections. Organized documentation speed approval processes and demonstrate professionalism to potential lenders.

Personal financial statements, include assets, liabilities, and income verification, support most financing applications. Bank statements, employment verification, and credit reports provide additional context for lending decisions.

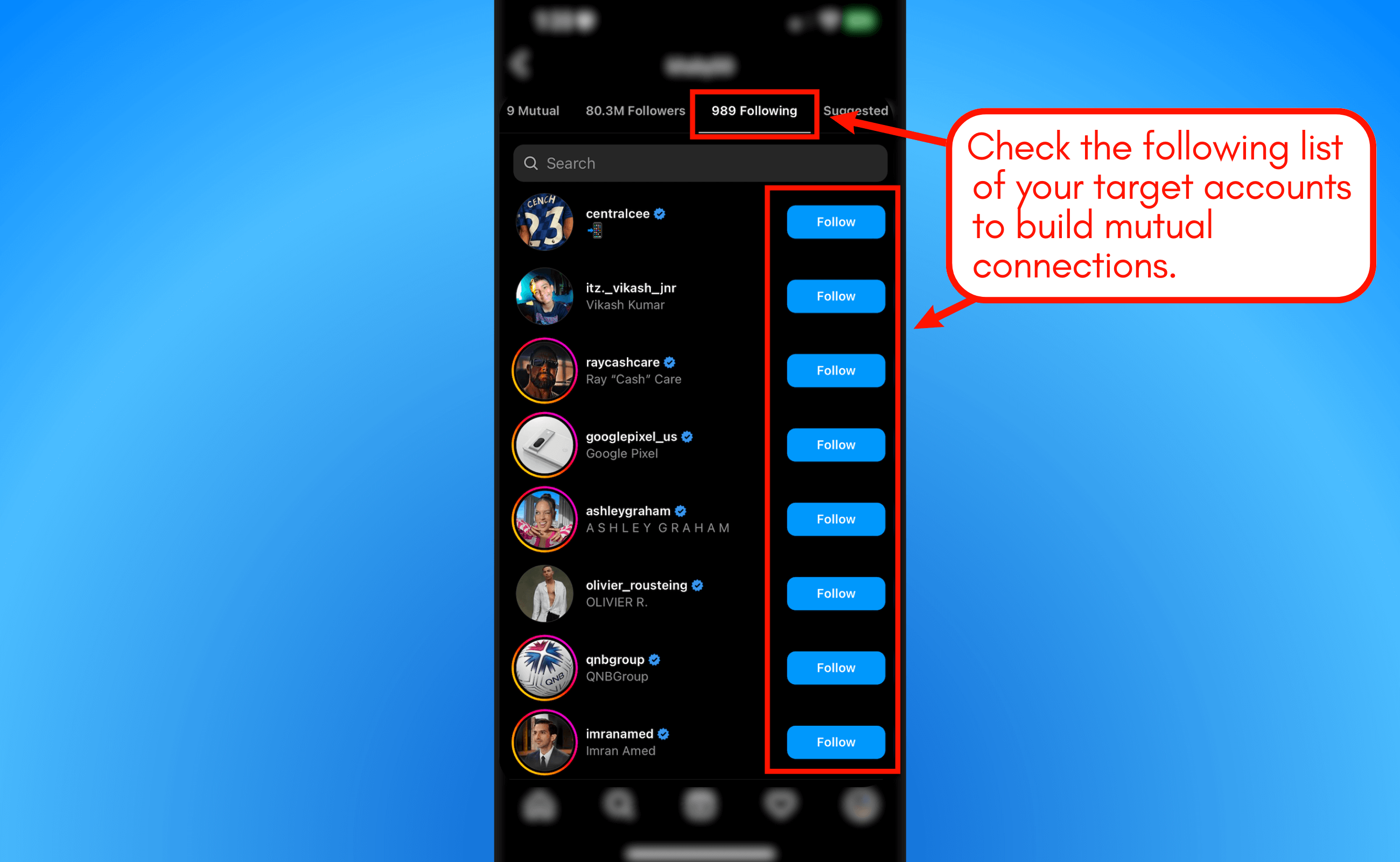

Credit optimization

Credit scores importantly impact finance terms and availability. Before apply for alternative financing, review credit reports for accuracy and address any discrepancies or negative items where possible.

Source: openstax.org

Pay down exist debt improve debt to income ratios, make you more attractive to lenders. Avoid open new credit accounts instantly before apply for major financing, as this can temporarily lower credit scores.

Consider the timing of financing applications, specially for recreational purchases that may have seasonal considerations. Boat financing, for example, may offer better terms during off season periods when dealers are motivated to move inventory.

Risk management and terms evaluation

Alternative financing oftentimes involve different risk profiles than traditional loans. Understand these risks and evaluate terms cautiously protect your financial interests.

Interest rate considerations

Alternative financing oftentimes carry higher interest rates than traditional bank loans. Compare annual percentage rates (aApr)kinda than fair interest rates, as apAprnclude fees and provide a more accurate cost comparison.

Variable rate loans may start with attractive rates but can increase over time. Fix rate financing provide payment predictability, which may be worth somewhat higher initial rates for budgeting purposes.

Promotional rates, common in medical financing, require careful attention to terms and conditions. Understand when promotional rates will expire and what standard rates will apply after.

Collateral and security

Secured loans use purchase items or other assets as collateral, typically offer lower interest rates but create risk of asset loss if payments aren’t maintained. Unsecured financing avoid collateral requirements but commonly carry higher rates.

Personal guarantees in business financing make business owners personally responsible for debt obligations. Understand the full extent of personal liability before sign business financing agreements.

Insurance requirements protect both borrowers and lenders but add to overall costs. Factor insurance premiums into total financing costs when compare options.

Make informed financing decisions

Successful alternative financing require balance immediate needs with long term financial health. Consider how financing decisions fit into your overall financial strategy and future goals.

Evaluate total cost of ownership, not equitable monthly payments. Lower monthly payments achieve through longer terms much result in higher total interest costs over the loan’s life.

Maintain emergency reserves yet when finance purchases. Alternative financing can sometimes involve higher payments or shorter terms than traditional loans, make financial flexibility important.

Consider prepayment options and penalties. The ability to pay off loans betimes without penalties provide financial flexibility and potential interest savings.

Alternative financing open doors to opportunities that traditional lending might not accommodate. Whether you’re pursued recreational interests, personal enhancement, or business growth, understand your options and prepare exhaustively increase your chances of secure favorable terms that support your objectives while maintain financial stability.